What's this? A Book!

Or buy here: Light Publications, Powell's, or Bn, Amazon A look at the lousy situation Rhode Island is in, how we got here, and how we might be able to get out. Featuring

Now at bookstores near you, or buy it with the button above ($14, or $18 with shipping and sales tax). Contact information below if you'd like to schedule a book-related event, like a possibly entertaining talk on the book's subjects, featuring the famous mystery graph. Join the RIPR Mailing List! For a weekly column and (a few) other items of interest, click here or send an email to ripr-list-subscribe@whatcheer.net. RIPR is a (paper) newsletter and a weekly column appearing in ten of Rhode Island's finer newspapers. The goal is to look at local, state and federal policy issues that affect life here in the Ocean State, concentrating on action, not intentions or talk. If you'd like to help, please contribute an item, suggest an issue topic, or buy a subscription. If you can, buy two or three (subscribe here). Search this siteAvailable Back Issues:

Subscription information:

Contact:For those of you who can read english and understand it, the following is an email address you are welcome to use. If you are a web bot, we hope you can't understand it, and that's the point of writing it this way. editor at whatcheer dot net Archive:

AboutThe Rhode Island Policy Reporter is an independent news source that specializes in the technical issues of public policy that matter so much to all our lives, but that also tend not to be reported very well or even at all. The publication is owned and operated by Tom Sgouros, who has written all the text you'll find on this site, except for the articles with actual bylines. Responsibility: |

Sun, 30 Dec 2007

Read here for a analysis better than I can write, of why I find the rhetoric of Barack Obama so problematic. I don't want someone who will seek reconciliation. I want to line up behind leaders who will, as David Addington (Dick Cheney's aide) put it so memorably, "Push and push and push until some larger force makes us stop."

00:47 - 30 Dec 2007 [/y7/de]

Thu, 27 Dec 2007

You might enjoy Despotism, from Encyclopedia Britannica films (1946). Did you know that progressive taxation is a defense of freedom?

22:37 - 27 Dec 2007 [/y7/de]

Check out footnoted.org, whose editor spends her time reading the footnotes of corporate filings. Listen to her on Marketplace.

20:01 - 27 Dec 2007 [/y7/de]

Wed, 26 Dec 2007

Another sign of our world-class health care system

It seems that the incidence of worms among inner-city residents is startlingly high and on the rise:

WASHINGTON (Reuters) - Roundworms may infect close to a quarter of inner city black children, tapeworms are the leading cause of seizures among U.S. Hispanics and other parasitic diseases associated with poor countries are also affecting Americans, a U.S. expert said on Tuesday.Recent studies show many of the poorest Americans living in the United States carry some of the same parasitic infections that affect the poor in Africa, Asia, and Latin America, said Dr. Peter Hotez, a tropical disease expert at George Washington University and editor-in-chief of the Public Library of Science journal PLoS Neglected Tropical Diseases.

I especially liked this part:

He noted a recent study by the Centers for Disease Control and Prevention, presented in November, found that almost 14 percent of the U.S. population is infected with Toxocara roundworms, which dogs and cats can pass to people."Urban playgrounds in the United States have recently been shown to be a particularly rich source of Toxocara eggs and inner-city children are at high risk of acquiring the infection," Hotez wrote, adding that this might be partly behind the rise in asthma cases in the country. Up to 23 percent of urban black children may be infected, he said.

14:20 - 26 Dec 2007 [/y7/de]

Fri, 21 Dec 2007

How long before this gets blamed on Clinton?

Read here.

13:52 - 21 Dec 2007 [/y7/de]

Thu, 20 Dec 2007

Several papers where my column was printed this week omitted this image, the cover of the annual welfare department report from 1936:

More modern welfare logos, from around the nets:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

21:46 - 20 Dec 2007 [/y7/de]

Pedestrians are second-class citizens

Two pedestrians were killed yesterday because there was nowhere for them to walk besides the streets.

I read this somewhere:

To be a pedestrian in Rhode Island is to be a second-class citizen, constantly reminded that you are less important than citizens who drive.

Oh, yeah. here or here (See p. 12.)

On the brighter side, my bus driver was handing out cookies this morning.

Read a little more after the jump.

There are some common experiences to trying to get around Rhode Island on foot. Traveling without a car in Rhode Island means committing to scrambling over berms and guard rails between bus stops and destinations, walking across four-lane streets with no crosswalks, wading across marshy median strips, climbing over unplowed sidewalks, and more. Bus stops are out by the road, with gargantuan parking lots to trek across before you get to the store. Standing next to the road in inclement weather means getting wet from drivers passing four feet away at forty miles an hour, and crossing the street means matching wits with aloof and occasionally hostile drivers. And there is not a "walk" button in the state that perceptibly changes the light when you press it.

Bringing these experiences to officials' attention is rarely productive. One is told that too few people walk to make it important (the very definition of a self-fulfilling prophecy) or that slowing down the traffic would make "people" wait, as if the pedestrians do not qualify as people. Putting in additional crosswalks is thought to create unnecessary traffic tie-ups and even though municipal comprehensive plans may require commercial buildings to be next to the sidewalk, and therefore convenient to pedestrians, planning commissions and town councils seldom insist on these kinds of restrictions, and regularly trade them away for other amenities.. After all, few of them walk. In other words, to be a pedestrian in Rhode Island is to be a second-class citizen, constantly reminded that your safety and comfort are rated far behind those of your fellow citizens in cars.

09:17 - 20 Dec 2007 [/y7/de]

Tue, 18 Dec 2007

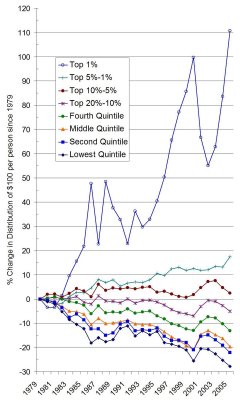

Here's an exciting graph, made here. This is the change in income share for various different sections of the population since 1979. You'll see that the top 1% of income earners did pretty well. How'd your neighborhood do?

See the link for all the details.

14:45 - 18 Dec 2007 [/y7/de]

Received this from the Treasurer's Office:

FYI. Rhode Islandís pension system is one of the most underfunded in the United States, in aggregate terms, according to a study by the Pew Charitable Trusts released today. Rhode Island requires a higher contribution from state employees (8.75% of salary) to participate in the pension system than all but two other states....

You can see the rest here and the full report.

The state employee pension fund (which also covers teachers) is indeed underfunded, but determining how fast we need to fix that is a source of contention. Were one to ask Treasurer Mollis why, if the underfunding is such a crisis, he doesn't demand that we pay off the unfunded liability next year. He'll say that's crazy talk, thereby making my point (made here and here and here and here) that reasonable people can differ about how fast it should be paid off.

The fact remains that Rhode Island is on a very aggressive schedule of repayments, and this costs us a lot of money to be more fiscally responsible than anyone requires us to be. If "fiscal responsibility" simply means spending your dollars wisely, then Rhode Island's citizens should know that a trade-off is being made in their names in favor of what banks call fiscal responsibility and against what other observers — the ones who notice the long-term costs of slashing education spending, for example — might also call fiscal responsibility.

11:50 - 18 Dec 2007 [/y7/de]

Thu, 13 Dec 2007

What a falling market looks like

In California, prices flew higher than here, by a lot, but the basic shape of the real estate price record was roughly the same: crazy run-up of prices, unsustainable, and not supported by real people, but by speculators. Now look here to see what it looks like on the Stockton Magical Mystery Repo tour.

Via K. Drum.

13:07 - 13 Dec 2007 [/y7/de]

Tax policy in Rhode Island is a game played largely in the dark. There has been very little data available about taxes the state collects and even less analysis of that data. The state budget has never contained a full accounting of the taxes we collect, for example, and it contained no accounting at all of the gas tax.

But a hazy light has appeared on the horizon, and the tax division and House Finance have cooperated on a new publication, Revenue Facts. This was apparently put out last month, but I missed the announcement party, I guess.

The first issue has some rough spots (a table on page 135 seems to be missing about 400,000 taxpayers, for example), but it is a vast step forward from what we have had. Happy holidays to all you little data elves.

Update: The table has been fixed.

08:22 - 13 Dec 2007 [/y7/de]

Sun, 09 Dec 2007

What's the good of an opposition party if it won't oppose?

22:56 - 09 Dec 2007 [/y7/de]

Sat, 08 Dec 2007

This is a very bad sign. The dollar's value is plummeting, and it will continue to plummet, so long as we have nothing the world wants to buy. Until recently, about the only thing we had that people wanted were financial assets. Foreign nations would sell us stuff and accept our dollars because they could re-invest them in US securities that would earn money, or because they could use the dollars to buy dollar-denominated goods from other countries. This last was mostly oil.

Well, no one wants to buy our financial assets this week, and now dollars won't get you any Iranian crude, either. There is very little incentive for the other oil-producing states to accept dollars, except to the extent that their wealth relies on US investments. This probably means that Saudi Arabia and Kuwait will not eagerly follow suit, but what about Venezuela, Indonesia, Norway and Libya? What have they got to lose?

Expect imported goods -- including oil -- to get a lot more expensive soon.

Oh, and congratulations to all the people who think that international power flows only from military might. You've got your wish, and US foreign policy has been conducted over the past 7 years as if guns and planes are the only thing that makes us powerful. But this is only an adolescent fantasy put forward by people who look good in suits, and so are thought to be Very Serious People. We are about to see it unmasked. Stay tuned.

The reality is that our power in the world derives from the strength of our economy, the value of our financial assets, the value of dollars in international markets, the fact that people from all over the world want to come here, and more such intangibles. As we chip away at each of these, we shouldn't be surprised as we lose power.

14:31 - 08 Dec 2007 [/y7/de]