What's this? A Book!

Or buy here: Light Publications, Powell's, or Bn, Amazon A look at the lousy situation Rhode Island is in, how we got here, and how we might be able to get out. Featuring

Now at bookstores near you, or buy it with the button above ($14, or $18 with shipping and sales tax). Contact information below if you'd like to schedule a book-related event, like a possibly entertaining talk on the book's subjects, featuring the famous mystery graph. Join the RIPR Mailing List! For a weekly column and (a few) other items of interest, click here or send an email to ripr-list-subscribe@whatcheer.net. RIPR is a (paper) newsletter and a weekly column appearing in ten of Rhode Island's finer newspapers. The goal is to look at local, state and federal policy issues that affect life here in the Ocean State, concentrating on action, not intentions or talk. If you'd like to help, please contribute an item, suggest an issue topic, or buy a subscription. If you can, buy two or three (subscribe here). Search this siteAvailable Back Issues:

Subscription information:

Contact:For those of you who can read english and understand it, the following is an email address you are welcome to use. If you are a web bot, we hope you can't understand it, and that's the point of writing it this way. editor at whatcheer dot net Archive:

AboutThe Rhode Island Policy Reporter is an independent news source that specializes in the technical issues of public policy that matter so much to all our lives, but that also tend not to be reported very well or even at all. The publication is owned and operated by Tom Sgouros, who has written all the text you'll find on this site, except for the articles with actual bylines. Responsibility: |

Mon, 28 Feb 2005

A special compilation of the LA Times/Johns Hopkins articles I linked to in December is now available. The question it asks is how far above the poverty line are you, and how little would it take for your family to fall? The answer is that over the past 25 years, it takes less and less. Go read.

14:48 - 28 Feb 2005 [/y5/fe]

RIPEC study looks at property tax

A report from RIPEC just out (I'd link directly to the report, but it's not clear how to do that from the RIPEC site) tells you what you already knew: property taxes around here are high and have been getting higher. Shocking, no?

The report tells us that the inflation-adjusted increase in property taxes has been 20% over the past decade. Interestingly, over that decade, we've seen a 10% cut in the income tax, and substantial cuts in federal aid. Hmmm.

The RIPEC report uses a $300,000 house to make the comparison between towns, and they find Coventry at the top of the list, and Block Island and Little Compton at the bottom. The catch, of course, is that finding a $300,000 house in Little Compton is, um, not so easy any more, while $300,000 buys you a lot of house in Coventry. Because of this, it is utterly unfair to draw the conclusion that this ranking begs you to draw: that Coventry manages its affairs poorly while Block Island is a model of good management.

Data (in any field) consist of numbers presented next to other numbers. A number in isolation means nothing. Which numbers you choose to compare with other numbers says a lot about what you think is the story. When I look at this RIPEC data, I'm not at all sure what story they're trying to tell about towns relative to one another.

However cloudy the details, the bigger picture is still clear: the property tax is the big deal around here, and until the Governor takes it seriously, and tries to do something about it besides blame towns for their spendthrift ways, it will only get worse.

11:02 - 28 Feb 2005 [/y5/fe]

Fri, 25 Feb 2005

You might enjoy this, but it might just make you mad.

16:00 - 25 Feb 2005 [/y5/fe]

Thu, 24 Feb 2005

The February issue of RIPR is off to the printers, and should be arriving in mailboxes by Saturday. It's got an analysis of the state pension system, public pension systems in general, and the lesser-known reason rates are so high (and getting higher) this year, and a list of tax proposals, any one of which would be better than the property tax increases we're looking at this spring. Wouldn't you like to subscribe, so you don't miss the fun?

11:30 - 24 Feb 2005 [/y5/fe]

It's budget season, and the budget documents are weighing down my desk. The silver lining to having your advice ignored is that you're free to offer it again the next year — I am a true believer in recycling. RIPR issues 1, 4 and 7 contain plenty of suggestions about overspending and unwise spending in state government, all still valid, some more so. (Other issues detail underspending, but no one seems to care about that this year.) Those issues describe departmental duplication, state-paid lobbyists, out-of-control borrowing, and more. If you're curious about how the state budget can be fixed, read them and then subscribe. You'll get the issues in a more timely and reliable way, and you'll get the satisfaction of helping to rationalize what passes for policy debate here in Rhode Island.

09:25 - 24 Feb 2005 [/y5/fe]

Another reason libertarians are wrong

An upcoming article in Behavioral and Brain Science (Henrich, Boyd, et al.), attempts to look at the reality of the self-interested economic individual at the heart of most of economic theory and libertarian thought. This was a cross-cultural study, looking for evidence of that 100% self-interested guy in cultures ranging from nomadic sheepherders to New Guinean mountain-dwellers, to university students. Oddly enough, they can't find him anywhere.

ABSTRACT: Researchers from across the social sciences have found consistent deviations from the predictions of the canonical model of self-interest in hundreds of experiments from around the world. This research, however, cannot determine whether this uniformity results from universal patterns of human behavior or from the limited cultural variation available among the university students used in virtually all prior experimental work. To address this, we undertook a cross-cultural study of behavior in Ultimatum, Public Goods, and Dictator Games in fifteen small-scale societies exhibiting a wide variety of economic and cultural conditions.We found, first, that the canonical model—based on pure self-interest—fails in all of the societies studied. Second, the data reveals substantially more behavioral variability across social groups than has been found in previous research. Third, group-level differences in economic organization and the structure of social interactions explain a substantial portion of the behavioral variation across societies: the higher the degree of market integration and the higher the payoffs to cooperation in everyday life, the greater the level of prosociality expressed in experimental games. Fourth, the available individual-level economic and demographic variables do not robustly explain game behavior, either within or across groups. Fifth, in many cases experimental play appears to reflect the common interactional patterns of everyday life.

The article is available, at least for a while, as a preprint here.

The way BBS works is that they invite commentary from hundreds of people, and usually publish dozens. So the issue that has this article in it (probably out in the summer) will be a lively one.

03:00 - 24 Feb 2005 [/y5/fe]

Wed, 23 Feb 2005

Medical malpractice: it's not all the lawsuits

An article in the New York Times looks at the recent increases in medical malpractice costs and concludes that tort reform won't help much, if at all, since the rising cost of settlements is only a part of the story and is partly a mirage, to boot. (They went down last year, for example.)

08:54 - 23 Feb 2005 [/y5/fe]

A post over at ripolicyanalysis.org takes me to task for presumably relying on a self-centered philosophy rather than on a philosophy dependent on natural law. (See here and here. He doesn't tag the entries, so I can't provide a direct link, but search on "12Feb" and you'll find the post.) Essentially he calls me a moral philosophical naïf.

The post is marred a bit by argument-by-scorn, but there are good points in it. Overall, though, it suffers because it argues against a fairly weak version of the opposition to his views.

The overall thrust of his arguments, in a nutshell, are that

- Natural law is a more secure foundation for explaining the morality of charity than is moral relativism,

- Natural law, embodied in Christian philosophy, outlines responsibilities the poor have towards those who give charity,

- Therefore it is ok to demand that people on welfare work for their benefits in order to receive them at all.

Here's a reply, but probably not the one he would expect.

First, let's stipulate that belief in natural law is not dependent on any specific natural law. In particular, you can believe there is a natural law that is not dependent on the fire-and-brimstone version so à la mode right now. A belief in natural law is merely the belief that there are absolute standards of right and wrong, and that these might transcend any particular individual's conception of them.

In other words, it is one thing to claim that there is natural law, and it is yet a different thing to claim you know what it is. (Not to mention that the second claim carries with it more than a whiff of hubris.) Relying on the Bible for more than general guidance is problematic, since the Bible is cryptic about important points, and self-contradictory about others. Biblical quotes can buttress a side in an argument, but they can rarely settle one.

The American Pragmatists had an answer to what you do when you don't know what is right: you continue the discussion. When Oliver Wendell Holmes wrote his defenses of free speech, his point wasn't that speech is inherently valuable. Rather, his point was that in order for our society to seek truth, it is necessary that all viewpoints be entertained. The bad ideas are discarded rapidly, but the good ideas will flourish. He wasn't seeking just to protect speech, but to protect a discussion, which he saw as the only path to truth.

In a way, this is only a reflection of what religious scholars have themselves been doing for thousands of years. You wouldn't think so, to hear about it from them, but Christians disagree among themselves about some fairly fundamental points of theology. So they argue about them. There are, for example, pro-choice Christian faiths, and Popes have endorsed evolution since Pius XII in 1950. Christians argue with Christians, Jews argue with Jews, and Muslims argue with Muslims. Some of these arguments go to the very base of their respective belief systems: questions about who is a Jew, or about the proper relations between an observant Muslim and unbelievers. Many of the arguments are long since settled, with consensus ruling. (But lots of those arguments were settled by expelling dissenters from the congregation and by angry schisms.) And many arguments continue to this day.

So discussion and argument are one route to uncovering the truth. But there are conditions to participating in the discussion. Mutual respect is one, since without it, no useful discussion can happen. The pragmatic view adds a second qualification: a belief in the empirical method, where testable facts outweigh emotional truths. For example, all may agree that some practice X is unproductive and ought not to happen. But we can disagree about how to prevent it. Some may claim we should simply forbid X and that will stop it, while others might say that education might prevent it. But there are two questions at play here. One is to ask whether practice X is immoral, and the other is how to prevent it. We can decide that the arguments on the first are inconclusive while still making progress on the second, and there is no inconsistency. On the second, we no longer have a moral disagreement, we have a testable proposition: what is the best way to prevent X? The pragmatic qualification suggests that (for example) if education is demonstrably better than interdiction at reducing instances of X, then we go with education, even if interdiction feels "righter" to some.

This is not an "anything goes" version of moral relativism. Sometimes people do manage to agree about whether some practice is immoral. There are broad areas of agreement about right and wrong on which human society is based. For example, according to anthropologists, condemnation of cheaters — which seems to be one of RIPA's main concerns — is actually pretty high on the list of potential universals in human society. His claim is that moral relativists can't be consistent when they condemn cheaters, since cheating may be some individual's route to self-fulfillment. But this is why I'm not a moral relativist, and why pure moral relativists are actually fairly scarce. (Which is not to say that there are no moral relativist responses to this criticism. But they can defend themselves.)

But really, if people agree that welfare assistance ought to be offered, what's the point of debating whether the moral authority comes from a Supreme Being or a Supreme Self? After all, if we agree on the outcome, who cares?

The answer seems to be reciprocal responsibility. After establishing the superiority of Christian morality, the RIPA argument goes further to say that Christian morality demands a responsibility not only from the rich to the poor, but also a responsibility by the poor to be grateful in return, and to show that gratitude, by becoming responsible members of society, and assuming the mutual obligations on which society is built. It's not 100% clear from the paper to what end this argument is aimed, but the only reason I can think of for bringing it up is to claim that this Christian requirement of responsibility justifies the programmatic requirement that welfare recipients work in order to receive benefits. (As well as, presumably, cutting off the aid of people who can't or won't participate in the entire program.)

It's an interesting point to claim that moral strictures about reciprocal responsibility justify placing conditions on charity, but I admit that I don't understand why it would still constitute true charity if there are conditions. In what way is it charitable to demand that you fulfill your responsibilities before I help you? Nor do I understand why it would be considered a sign of fulfilling their responsibility for the poor to fulfill what is presented as a requirement. Morality and responsibility are words for people who have a choice, not for people under the thumb of authority. Was it the responsible thing for me to attend fourth grade every day? You could construe it that way, but I can't recall any way in which I could be said to have had a choice in the matter, so I'm not sure how moral that makes me.

Once we're talking about requirements like this, it is clear that what is being offered is not charity in the sense that Jesus or Thomas Aquinas, for example, might have used the word. Rather, we're talking about a utilitarian kind of arrangement, perhaps the most efficient way to keep the streets clean of what Dickens called human refuse. Gifts are not gifts if they have conditions, they are bargains. Bargains aren't necessarily bad, but they also are not something you can count against your sins in your personal ledger of progress toward salvation.

But all that aside, the important thing to notice is that there is an empirical question hiding here: are the poor who receive welfare benefits ungrateful? Do they, in fact, refuse to contribute to the society that has contributed to them? To present the argument in the way it's done in the paper under discussion implies certain knowledge of the answer to this question. I doubt that the author can justify his certainty. Rather, this is just verbal shorthand, reference to those common "facts" on which he assumes we can all agree. Well, without more concrete demonstration than this, I can't agree. Besides, I have only a few data points at my command, so wouldn't presume to speak for the whole, but those data points — i.e. those people I know who have spent time on welfare — tend to refute this hypothesis.

The RIPA argument betrays a common stereotype: the undeserving

poor. Well sure there are some. But there are also some undeserving

rich, and no one seems to get hot under the collar about them any more.

Why is it that the ones who have assistance to give are to be

considered virtuous enough to do their duty unbidden, while the ones

who need it are assumed to be, um, not? Is it simply that money

itself has ennobling qualities? Count me as uncertain.

Update: I added a clarification to the word "gratitude" to point out that the RIPA doesn't argue that the poor need to give literal thanks, but that the idea is that they are bound to reciprocate by becoming responsible members of society.

01:52 - 23 Feb 2005 [/y5/fe]

What is usually meant by "Economic Development Policy" — tax breaks for this or that company, special loan deals, real estate help for relocation, and so on — is seldom worth while. Here's an op-ed about an alternate vision.

00:21 - 23 Feb 2005 [/y5/fe]

Fri, 18 Feb 2005

A story in the Financial Times about global warming reports on a AAAS meeting session on the subject in DC. The FT quotes Tim Barnett, of Scripps Institute of Oceanography: "The debate over whether there is a global warming signal is over now at least for rational people."

(What he means by "signal" is "detectable and characteristic changes that can't be attributed to anything else we know about." And he's specifically talking about human-induced global warming.)

22:46 - 18 Feb 2005 [/y5/fe]

Wed, 16 Feb 2005

Cutting the safety net, one strand at a time

An article in the Economist's Voice points out a couple of important facts.

One: you regularly hear crowing that cutting welfare benefits has no effect on poverty. But this is because the trend in government anti-poverty programs has been away from cash grants and towards in-kind services (health care, food stamps, housing subsidies, and so on). Those weren't cut nearly as much, and usage has grown, not shrunk, since 1996.

Two: Those programs are now at risk due to Bush and state budget cuts.

Three: The idea that these programs "don't work" is usually built on a foundation of bad research or no research at all.

The author spends time on these, but also on some other poverty mythology. Here's what the author — Janet Currie, a UCLA economist — has to say about one myth. But it's worth reading the whole thing. EV is a journal for economists to write in, but it's meant to be easy reading, so it's not technical. Go read it.

So suppose we see, for example, that children who attended Head Start are still more likely to drop out of school than the average child. This tends to confirm our worst suspicions about the futility of government intervention to break the cycle of poverty. The comparison of the Head Start child to the average child tells us that Head Start did not, by itself, solve the problem of poverty. But this tells us nothing about whether the program benefitted the target child. To answer this question, we need to ask: "Are children less likely to drop out than they would have been without Head Start?" When the question is posed this way, the answer begins to look much more hopeful.Put another way, a sensible analysis of the effects of government anti-poverty programs has to take account of the fact that these programs typically serve the most disadvantaged families. Reports on the programs' effectiveness must take as a given that participants are not the "average child."

When estimates of program effects do take proper account of selection (which is the technical term for the difference between the average child and the child actually in the programs), they typically find that in-kind anti-poverty programs are — contrary to popular opinion — quite effective. Expansions of Medicaid to low income children and pregnant women have reduced infant mortality and improved medical care for millions of children, increasing their probability of graduating from high school as much as a quarter. School nutrition programs generally provide healthier meals than students would otherwise receive, and WIC improves the health of newborns and reduces hospital costs. For example, WIC participation has been estimated to reduce the risk of low birth weight by 10 to 43 percent.

09:11 - 16 Feb 2005 [/y5/fe]

Tue, 15 Feb 2005

A little development can be too much

An article in the Baltimore Sun looks at some research from the Smithsonian Environmental Research Center on Chesapeake Bay. The findings are, in a nutshell, that even the generous setbacks and buffer zones recommended for coastal wetlands aren't enough to preserve the productivity of those marshes.

Overall, SERC found that developing as little as 14 percent of tidewater regions triggered a drastic decline in marsh-dwelling birds like rails and herons.A minimum buffer of some 1,500 feet was needed to protect marsh birds. Where development was as much as 25 percent, a 3,000-foot buffer was needed.

Even a 10 percent level of development was enough to push PCBs in perch up tenfold. Once development reached 35 percent, the fish were often so contaminated that Environmental Protection Agency guidelines advise no consumption.

The rest is worth reading, too.

09:58 - 15 Feb 2005 [/y5/fe]

Mon, 14 Feb 2005

Over at Washington Monthly, there is a post about how the administration uses low growth estimates to predict a problem with funding Social Security, while also expecting high returns on people's "private" accounts. This is, historically, an improbable set of circumstances, and the fact that it's in use by administration economists gives one pause.

But on the other hand, the economic policies — government and private-sector — of the last 25 years have all been to favor the profitability of corporations at the expense of the people who work at them. Assuming that corporations can continue to bring great crowds of poor workers into their markets, they can, in fact, continue to stiff the ones here at home. Think of it as replacing the Henry-Ford-five-dollar-wage model with the Wal-Mart model of economic expansion. This will eventually lead to a situation where the profitability of "US" corporations does, in fact, consistently outpace the rate of economic growth measured in this country. One's a global thing, the other national. The growth will be unsustainable, but that's not the point. Investors may see higher profits, at least for a while.

21:55 - 14 Feb 2005 [/y5/fe]

Over at RI Future, there are some excellent suggestions about Providence City policies. The concern is that Providence is getting moving again, which is a good thing, but the effect on the housing market of this kind of movement is not always good.

Once again, we have been in a housing crisis, we are in a housing crisis, and we will be in a housing crisis until we choose to act on it in a serious way. Suggestions like these will not end the crisis, which I think will require market intervention, but they will help, and in a crisis, every little bit counts.

12:52 - 14 Feb 2005 [/y5/fe]

Sun, 13 Feb 2005

The next RIPR will be out late this week. Included will be the annual analysis of the state budget, including ideas both for cost savings and for reconfiguring the tax burden on Rhode Islanders to make it more fair. I've also been spending time with reports from the state retirement system, which covers state employees and almost all the teachers in the state, and have learned some interesting things. Why not subscribe now?

22:39 - 13 Feb 2005 [/y5/fe]

Unpublished Parts of the Federal Budget

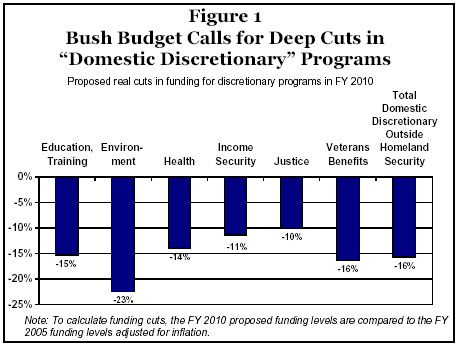

Staff members at the Center for Budget and Policy Priorities spent some time with the backup material the Bush administration used while presenting their plans to the House and Senate budget committees. What they found (see here) was that the cuts published in this year's budget were only a small part of the plan.

In a break from standard practice (instituted in 1989 by George H. W. Bush), the new federal budget documents only show the cuts for specific programs for the first year. Beyond that, there are aggregate figures, but nothing for specific discretionary programs.

Spending some time with those backup documents, the CBPP staff

found cuts far more draconian than anything presented in the news.

Here's one of their figures, for laughs. Go read it, though.

The authors also note that the administration is on record as saying that the cuts were just the result of a "formula." The implication is that an attempt was made to share the pain equally across many departments. But the CBPP could think of no formula that might result in the cuts shown. Putting aside Homeland Security spending, cuts in the Department of Energy will run around 33%, cuts in EPA funding will run around 20%, VA funding around 16%, the Justice Department around 10%. If it's a formula, it's a pretty complicated one.

22:34 - 13 Feb 2005 [/y5/fe]

Fri, 11 Feb 2005

Wal-mart closes unionizing store

Wal-Mart workers at a store in Canada actually voted to certify a union, but in negotiations, the company said it can't operate under anything the union had to offer. So they're closing. Story here.

When you've got thousands of stores around the world, what's one store, more or less?

12:08 - 11 Feb 2005 [/y5/fe]

Why to care about social security

Read a story in the New York Times about lots of people's retirement plans. Essentially the story points out that lots of companies are punting on their promises to retirees, so oddly enough, there are fewer people who can actually afford to retire.

The article had this gem:

Lucent, for instance, has only 20,000 active workers in the United States to generate the business needed to help support nearly 120,000 retirees, whose health care last year cost about $775 million, an amount equal to 70 percent of Lucent's net profit. So the company has been aggressively paring the health insurance it offers its retirees, prompting older employees to rethink their retirement plans.

Lucent, of course, is what's left of AT&T Bell Labs. But those 120,000 retirees didn't all come from the Labs. Lots of them came from other divisions of AT&T, but were attached to Lucent when it was spun off from the long-distance and cell carrier. In other words, Lucent was meant to dwindle and die as soon as it was granted an independent existence. The people who stayed with Lucent apparently weren't all in on the joke.

00:33 - 11 Feb 2005 [/y5/fe]

Wed, 09 Feb 2005

An editorial in today's Projo would have us believe that Bush's tax cuts were a bipartisan project. They wrote about the cuts:

...let us remember, [the tax cuts] got wide support from Republicans and Democrats when they were enacted.

This is rewriting history. Let this post be a meagre attempt to push back. In 2001, 12 Democratic Senators and 28 Democratic Representatives went on record in favor of those cuts. So that's 24% of D Senators and 13% of D Representatives. Is that "wide" support?

Here's a record of the 2001 vote.

Here's the clerk of the House web site, so you can check my math.

11:25 - 09 Feb 2005 [/y5/fe]

Tue, 08 Feb 2005

In President Bush's new budget, whose details are just out, there is a new $3.7 billion "Strengthening America's Communities Grant Program" (in the Commerce Department) meant to address housing and economic development issues in poor communities. Of course this program is really the combination of 18 other programs from five agencies, who were funded last year at $5.6 billion. So it's a cut, and a pretty fierce one.

Community Development Block Grants, used for various kinds of aid in poor communities—construction of affordable housing, senior centers, parks and day care centers, providing water and sewers to poor neighborhoods and services to the homeless—are to be part of the new program. They alone are currently funded at $4.7 billion this year. They also used to be part of the Department of Housing and Urban Development (HUD), whose aim is supposed to be developing healthy cities. The program, to be moved to the Commerce Department is apparently also supposed to be refocused on job creation. (As if that's not what they were doing.)

The CDBG program is said by the administration to be "ineffective." Here's what the director of the National Low Income Housing Coalition had to say about it:

The question about the effectiveness of CDBG seems to center around whether or not spending this money has made any difference. To answer that, we need to know what results were expected and if the level of funding and the structure of the program were sufficient to achieve them. If the expectation was that CDBG would ameliorate some hardships for people who live in poor communities, it was designed and funded so as to achieve success. If CDBG was expected to transform whole cities and end poverty in them, the program has been woefully shortchanged.But please do not get sidetracked into thinking this "reform" has anything to do with CDBG being effective or not. CDBG is just an easy target in this year of budget cuts made necessary by the mounting federal deficit. It is the people in poor communities for whom CDBG does make a difference who are expected to sacrifice to help reduce the federal deficit, while wealthy Americans are enjoying the tax cuts that caused the deficit and sacrificing nothing.

08:11 - 08 Feb 2005 [/y5/fe]

Mon, 07 Feb 2005

Just so you know, the story that the President was cheating in the debates with John Kerry has been confirmed by reporters at the New York Times. But editors there decided not to run the story in the days before the election on the grounds that it would affect the election. Read about it here.

Said Ben Bagdikian, former dean of the Journalism school at UC Berkeley:

I cannot imagine a paper I worked for turning down a story like this before an election. This was credible photographic evidence not about breaking the rules, but of a total lack of integrity on the part of the president, evidence that he'd cheated in the debate, and also of a lack of confidence in his ability on the part of his campaign. I'm shocked to hear top management decided not to run such a story.Wouldn't it be nice if we could rely on the press to keep us informed?Cheating on a debate should affect an election. The decision not to let people know this story could affect the history of the United States.

11:17 - 07 Feb 2005 [/y5/fe]

Fri, 04 Feb 2005

I was talking with a friend about a proposal to give health insurance groups a claim on the money they contribute to reserves. She replied:

Health insurers take in payment to provide services. They figure that they'll take the payment, invest it, earn money, and then provide services.

Providing services is not what health insurers do. They provide money, not service. There's a certain amount of service they provide in billing, but they've created most of that mess themselves, so I don't think it's fair to call negotiating that mess an important service they provide.

The money insurers provide they provide out of the pool of premiums paid in. At the end of the year, the money left over goes into their reserves, and is booked as "lost" for the purposes of the pool who paid it in. Say I'm the town administrator of town XYZ. We pay X dollars for our 1000 employees. At the end of the year, our expenses have been 90% of X. That extra 10% goes into the insurer's reserves, and is lost to us.

Fine, you say (and they say), but in the bad years, when your expenses are 110% of X, we pay out the difference. And this is true, except that they invariably explain politely to town XYZ that circumstances require that they raise XYZ's rates by 10% the next year. So on the low-expense years, they sock money away in the reserves and on the high-expense years, they lose money, but only until next year.

But now let's look at that bad year. By the end of the year, the insurer says we've spent 110% of your premiums, so we need to hike the premiums. At that point, only around 70% of the premiums are actually spent. The rest is in reserve, both for claims that they know about and for claims that they don't know about. It won't actually be spent for quite some time (and the higher premiums will be rolling in by then, anyway). But the insurer calls it "spent". It's not actually spent, it's now part of the reserves, earning interest, but not on behalf of the town.

The way risk works is that if you've estimated the risk right, half of the years you'll come out ahead and the other half you'll come out below. But the way the insurance system actually functions in practice insurers come out ahead every year. Say an insurer's actuaries estimate that the risk of cancer in town XYZ is two cases per year. Just because three people in town XYZ died of cancer in 2004 doesn't mean that the actuaries are wrong. But insurers typically suggest that bad years are proof that their actuaries are incorrect, and they don't absorb the loss, they pass it on.

Banks, though, are not selling a service per se, except the ability to invest ones money. They invest it, take their profits, and then give us whatever interest is left over, right?

You give money to a bank, they invest it, and when you want it, they have to figure out how to give it back to you. They don't ever have more than a small fraction of their deposits on hand, and there is some risk there, but they manage it.

So my point is that unless the insurers occasionally take the loss (which does sometimes happen in P&C insurance), then the money isn't really theirs, but it still should be thought of as belonging to the group in question. They'll still wind up raising their rates in the bad years, but this is what happens now, and if they can carry a surplus forward, maybe it won't happen so much.

So far, the investment income hasn't even been mentioned. If the deposit belongs to the town, presumably some of the income should, too. As you point out, this is how banks do it. The aggregate reserve of Blue Cross wouldn't decline, but it would get many claims made on it. Right now, they mostly use their reserve to scare away competitors and to waste on stupid studies. I bet United uses some of theirs to invest in its own stock so to keep its CEO's stock options valuable. This is not a small reform, of course, and is not normal, either. But insurance industry practice is a real problem. Apart from the rapacious drug companies and the absurd salaries for hospital CEOs, we have a system with built-in inflation.

11:37 - 04 Feb 2005 [/y5/fe]

Thu, 03 Feb 2005

This appeared in the Congressional Quarterly today:

FORMER GOVERNOR PUTS THE SMACKDOWN ON STATESHHS Secretary Michael O. Leavitt went public yesterday with the administration's intent to rein in the cost of Medicaid.

The former Utah governor outlined ways to save $59.5 billion over 10 years from Medicaid. In a speech at the World Health Care Congress, he said a key reform was ending "loopholes and accounting gimmicks" used by states to claim money not entitled to them. Leavitt estimated this could save $40 billion over 10 years. Governors weren't pleased.

Rhode Island operates the RIte Care program under a "waiver" of Medicaid rules granted by the federal HHS. This allows RI to offer more-generous benefits than is the norm among states, and to offer the insurance to people who are not receiving welfare. RIte Care money also goes to other agencies, like RIPTA, for assisting the same population in keeping jobs that don't pay benefits. Unfortunately, the waiver is not permanent, and must be re-requested every three years. This is coming up.

The CQ piece goes on to say that the government has begun "cracking down on the practice of using Medicaid funds for non-health care needs." Which is to say that Bush's budget will put quite a lot of Rhode Island's program in jeopardy.

10:43 - 03 Feb 2005 [/y5/fe]

Wed, 02 Feb 2005

E-news from the Governor:

Carcieri Gives Affordable Housing a BoostToday Governor Carcieri announced three initiatives to boost the availability of affordable housing. In a press conference in South Providence, he said he is bringing together various elements of state government to focus on the crisis.

"I am establishing an Office of Housing and Community Development which will bring together housing programs that are currently dispersed throughout state government and put them under one roof," Governor Carcieri said.

"This will enable us to have an effective, cohesive, efficient approach to addressing complex housing issues. The members of this office will work closely with housing advocates and experts in the field to ensure that we have safe, affordable housing readily available for Rhode Islanders."

Applause is due for trying to get these programs together to work in concert. But the amount of money involved is tiny.

Governor Carcieri has placed a high priority on resolving the housing crisis. In the past two years, he has provided $10 million for the Neighborhood Opportunities Program. This year's $5 million allocation will bring the total to $15 million, establishing a firm foundation for the initiatives announced today.

The residential real estate market in Rhode Island is rather larger than this. In the first nine months of 2004, $2.4 billion of residential real estate was sold, according to the MLS folks. In this context, $5 million a year is pretty easy ot overwhelm.

As has been argued here before, the housing crisis is not a crisis if you look at it as the proper function of a housing market: the market clears so everyone who has a house can sell it. This is what unregulated free markets do.

But this market has also brought us housing prices that have risen many times faster than inflation over the past five years, and anyone who doesn't think there's a crisis of affordability (a) already owns their home and (b) never looks at their property tax bill.

For reasons that remain unclear to us, you can talk about affordable housing, and scrounge for financing here and there, and talk about town comp plans that need affordable housing components and so on, and no one minds. You're a reformer, and we need them. But the moment you suggest that perhaps a bit of market regulation would be appropriate to curb the excesses of the market, you're a wild-eyed radical.

Once again, because we don't trust free markets, we regulate the market in taxicabs, tow trucks, and cigarettes. Real estate controls were wildly popular in the communities where it was tried in Massachusetts. Why not here?

09:27 - 02 Feb 2005 [/y5/fe]