What's this? A Book!

Or buy here: Light Publications, Powell's, or Bn, Amazon A look at the lousy situation Rhode Island is in, how we got here, and how we might be able to get out. Featuring

Now at bookstores near you, or buy it with the button above ($14, or $18 with shipping and sales tax). Contact information below if you'd like to schedule a book-related event, like a possibly entertaining talk on the book's subjects, featuring the famous mystery graph. Join the RIPR Mailing List! For a weekly column and (a few) other items of interest, click here or send an email to ripr-list-subscribe@whatcheer.net. RIPR is a (paper) newsletter and a weekly column appearing in ten of Rhode Island's finer newspapers. The goal is to look at local, state and federal policy issues that affect life here in the Ocean State, concentrating on action, not intentions or talk. If you'd like to help, please contribute an item, suggest an issue topic, or buy a subscription. If you can, buy two or three (subscribe here). Search this siteAvailable Back Issues:

Subscription information:

Contact:For those of you who can read english and understand it, the following is an email address you are welcome to use. If you are a web bot, we hope you can't understand it, and that's the point of writing it this way. editor at whatcheer dot net Archive:

AboutThe Rhode Island Policy Reporter is an independent news source that specializes in the technical issues of public policy that matter so much to all our lives, but that also tend not to be reported very well or even at all. The publication is owned and operated by Tom Sgouros, who has written all the text you'll find on this site, except for the articles with actual bylines. Responsibility: |

Fri, 25 Sep 2009

Last week saw another chapter in the saga of the floating homeless encampment. First this camp of up to 80 homeless people was Camp Runamuck under a Rt 195 bridge in Providence. Then they moved to East Providence. Then, with their numbers dwindled to around 20, to some commercial land in Providence. Now they're going to have to move from there, since the land isn't zoned for, um, protest camping.

It's a fascinating story, especially to hear about the camp's success with experiments in self-government, and there is some dark amusement available in wondering where they'll pop up next. But the tale of this doughty band tends to obscure some darker currents going on in the background.

For one thing, does anyone wonder why these guys are still camping? Told to leave one spot, they go to another rather than disperse. Told to leave that one, they still hang together. It all seems a jolly outing from the news reports, but it's not like the welcome sign is hanging from our bridges. Our state has homeless shelters, doesn't it?

Well, we do. But a funny thing has happened due to the foreclosure crisis and the recession during the past year. That is, our shelters are mostly full. According to the Coalition for the Homeless, there are as many people in the shelters this month as there usually are in mid-winter. And it's still nice outside. What will happen when it gets cold?

That's easy: The shelters will become overcrowded. I saw a graph of the numbers of homeless people in the shelter system in Rhode Island over the past couple of years, and it's been going up so fast you couldn't even see the usual summertime dip in the count. Last February saw 43% more homeless clients in shelters than one year before that, including an increase of 13% in the number of homeless children.

Many people are homeless because of mental illness or substance abuse problems. But these are not problems that appear as suddenly as this wave of newly homeless people has. So what's the story? One way to explain it is that people have lost their jobs. But this only explains one side of the problem, and homelessness has two causes. It's not just people with suddenly less money than they once had. It's also housing that costs too much.

Put more simply, the issue is that our housing market has not provided the volume of housing units at low cost that our friends and neighbors need. The slump has not yet brought prices down significantly. RI Housing data I saw this week says that most sellers seem to be holding out for high prices, even though the occasional bargain can be had on foreclosed property. For many people, it's difficult to find housing less expensive than the housing they're already in, and so those people are at serious risk of homelessness when a disaster strikes.

It was not always this way. Fifty years ago, there were single-room-occupancy (SRO) hotels available for people whose housing needs were low and means modest. There were also boarding houses and worker hostels. These weren't always particularly nice places to stay, but any of them were better than sleeping in the open in December, and all of them were cheaper than an apartment. But these forms of housing have mostly gone the way of the telephone booth, and there is little beside the shelter system to take their place.

Why are these gone? Mostly money. Ultimately, the reason why there isn't much housing for poor people is that there simply isn't enough money in it. It's more profitable to rent apartments than it is to rent single rooms, so there are no more SRO hotels. And it's more profitable to build condos for the upper end than it is to rent apartments, so even apartments have become scarcer than they once were.

The SROs didn't disappear so very long ago, either. There were at least a couple in downtown Providence through the 1970s, and New York City was fighting their conversion to apartments well into the 1980s. (A very small number did survive there and in San Francisco.)

Building codes and labor costs are among the common explanations why housing costs are so high, but they do little to explain the expense of housing in structures that weren't built recently, and they do nothing to explain the disappearance of these alternative forms of cheap housing.

What does explain this loss is a market whose pressures push developers to aim at the top of the income spectrum, and planning and zoning authorities who give in to those pressures far too often. Gentrifying neighborhoods bring in more property taxes, but at the expense of SRO hotels and other low-cost housing. And it's not as if this process is only in our past. As far as I can tell, the hunger for property tax revenue now drives almost all municipal planning decisions, so these problems will persist until the rules of the game are changed.

Markets are wonderful things some of the time, but they simply don't deliver the social goods unless the prices are right. Housing for poor people will always be a problem until such a time that the market changes, or until we decide to change it. Until then, Camp Runamuck and its successors will always be with us.

15:57 - 25 Sep 2009 [/y9/cols]

Fri, 18 Sep 2009

To get out of a hole, the first step is to stop digging.

It was a relief to see last week that the Governor and the state employee unions have come to an agreement (maybe) about how to achieve the savings in operations that the Assembly put into the budget in June, but it's a sign of how far gone things are that the amount in question was only a small fraction of the likely deficit in our budget.

According to the budget deal signed this spring, the Governor was supposed to come up with $68 million in savings that hadn't been specified yet. He chose to take the bulk of that from payment already promised to city and town governments, and by giving state employees 12 unpaid days off. They objected, and now it seems they'll still take those days, but there will be the opportunity to get some of it back in the future.

I'm glad the public employee unions have come to an agreement to forestall layoffs, but I continue to wonder what other shoes are going to drop soon. In November we'll have the semi-annual revenue estimating conference, and knowledgeable people I've spoken to are working on the assumption that we'll be looking at a deficit in the hundreds of millions. Again.

What to do about this debacle? How do we get out of the hole we're in? How about we begin by stopping the digging? The fact is, we're making the hole deeper even while we wonder how to get out, and that seems a bad strategy, at least to me. Even now, while the Governor is withholding $32 million in local aid from cities and towns, we are in year 4 of a 5-year tax cut aimed at the richest Rhode Island taxpayers. In other words, official state policy now is dedicated to the idea that the single worst thing we could do is to stop these tax cuts.

Is this evidence of serious thought? How sure are you that revoking those cuts is worse policy than shutting down libraries and cutting schools? Municipal budgets are (or were) already balanced under terrible circumstances this spring, with three communities being forced to exceed the 4.75% property tax limit and 11 more barely remaining under it. Overall, we're looking at 3.5% increases across the board. Now those same communities are looking at further cuts.

I was also amused to read about a House hearing this past week to look at why federal stimulus funds received by the state supposedly haven't been spent fast enough. As of now, seven months into the program, only about 8% of the funds have been spent. This isn't good, but spending highway money isn't the only way to stimulate the economy. How have we done on others?

Contrary to popular belief, the economics of John Maynard Keynes was not all about government. He described his own theory as conservative, sort of saving capitalism from its own excesses. His big point, the one that gets him remembered, is that investment can't drive an economy. You won't get investment from investors simply by providing the money in the form of lower taxes or low interest rates. You get investment when there are real business opportunities for investors to invest in. And business opportunities require customers who want to buy.

Before Keynes, it was thought that we could get out of the Depression by lowering interest rates, and with tax cuts to wealthy people. Roughly speaking, that's what Hoover tried. Keynes pointed out that raising taxes and interest rates could decrease investment, but that business people aren't dumb, so who is going to start a new business when no one can buy? In other words, lowering taxes and interest rates will only work to increase investment if sufficient demand exists to provide business opportunities. He said that, absent those opportunities, making investment easier is like "pushing on a string."

For real stimulus, you want to put money in the hands of people who will spend it. But what have we done along those lines? We're raising property taxes, which fall heaviest on poor people and in the middle, and cut taxes on rich people who save most of their income. We're laying off and cutting the pay of state and municipal employees. We've hardened welfare rules yet again, making that program even less useful to poor people.

In other words, at pretty much every choice point, we've taken money from the people who will spend it -- the opposite of stimulus. Even if DOT got all the federal stimulus money out without following its legally-mandated bidding requirements, we'd still be in trouble because they'd be working against every other lever of government. The Finance Committee will cast about for scapegoats, but they are working against the stimulus they claim to support. If they believe that stimulus is important, let them show it by changing our state's depressive economic policy.

23:07 - 18 Sep 2009 [/y9/cols]

Thu, 17 Sep 2009

Wayland Square, Wakefield and Westerly

Update: Due to logistical concerns, the Other Tiger event has been postponed to October 23.

This coming week I'll be appearing at some area bookstores to talk about state government, our economy, and the pickle we're in, and maybe sign some copies of my book. Please come join me at:

- Books on the Square in Providence on Tuesday September 15, at 7pm

- Myopic Books in Wakefield on Thursday September 17 at 7pm

- Other Tiger bookstore in Westerly on Friday the 18th at 5pm

21:27 - 17 Sep 2009 [/y9/se]

Wed, 16 Sep 2009

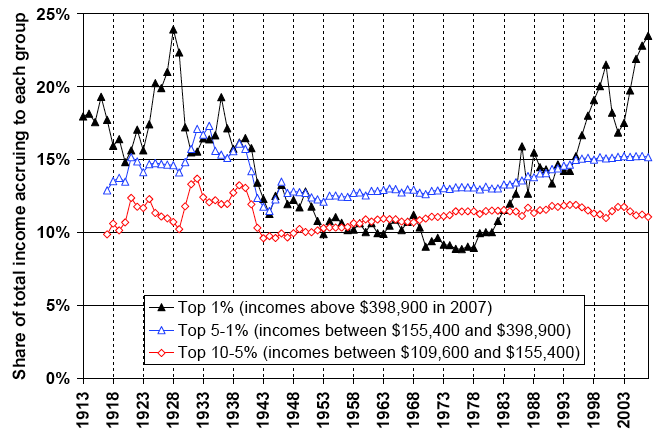

Emmanual Saez has updated his article, "Striking it Richer: The Evolution of Top Incomes in the United States". Here's his rendition of what's been happening to incomes at the top end. One interesting thing is the extent to which the benefits of the past few years have accrued not to the top 10%, but to the top 1%. The tapayers in the 5th through 10th percentiles haven't done so well at all.

10:12 - 16 Sep 2009 [/y9/se]

Mon, 14 Sep 2009

Health care for illegal immigrants?

Many may get it after all. From Mexico. (via)

08:09 - 14 Sep 2009 [/y9/se]

Fri, 11 Sep 2009

Economic acts of God -- or not.

Events are changing too fast in our state's budget debacle for a weekly columnist to keep up, but the Governor's threat of layoffs brings up a chapter in our history that I wish would get more attention.

Here in 2009, it's possible to look around the wreckage of our industrial economy and wonder what happened to all our factories? In a way, it's pretty obvious, really. Competitive pressures forced many companies to leave for cheaper wages. We all know that. But what seldom gets any attention is the extent that this was the result of conscious policy choices by your governments.

For example, did you know that until the 1980's, it was considered illegal to close a unionized factory just to move to cheaper labor costs? A 1981 Supreme Court decision and a 1982 ruling by the National Labor Relations Board made it clear that reducing labor costs alone was not enough to justify abrogating a union contract. But time is capable of eroding judicial decisions as well as rocks, and only a few years later, Ronald Reagan's new NLRB appointees and new Supreme Court justices clouded or retracted those decisions, creating loopholes quite large enough to move factories through.

But, you say, what about the competition from foreign factories where the labor costs were so much lower? How could a high-cost US factory compete with the low-cost Asian factories? In return I ask where those factories found the financing to open in the first place? For the most part, they were financed by the company moving the production, either directly, or by using production contracts to secure financing.

In many cases, American companies would have found little competition for their products from Asia, even if it was easy for them to move production there. For example, it beggars belief that a Chinese company would ever have found independent financing to make a US soldier doll to compete with Hasbro's G.I. Joe. Who besides Hasbro would ever have financed something so crazy? China is where they are made only because Hasbro chose to move production there.

Certainly there are cases where a foreign competitor has prevailed over an American company. Ask anyone in Detroit, for example. But does anyone seriously claim that Toyota has surpassed General Motors as the world's largest car company only because its cars were cheaper? True, this is a popular claim among union-bashers, but back issues of Consumer Reports say otherwise.

The other important obstacle to moving production elsewhere was import restrictions. But the free trade movement of the Bush I and Clinton years took care of most of those. India and China are much more prosperous places today than they were 30 years ago, and that's no small thing, but it wasn't an accident, either.

There's much more, I'm sorry to say. For another example, remember all the leveraged buyouts of the 1980's? Think of the corporate carnage as buccaneers like Carl Icahn and T. Boone Pickens bought companies by mortgaging them to the hilt, and then selling off and liquidating the pieces? Tens of thousands of people were laid off at a time in some cases, and the wreckage included many research and development divisions, corporate futures sacrificed on the altar of the short-term bottom line.

Corrupt financiers Ivan Boesky and Michael Milken supplied funding for many of these escapades, but did you know that most of the transactions were driven by bad tax law? Corporate profits and dividends were taxable, you see, but if a company uses its revenue to make debt instead of dividend payments, those are a cost, not a profit, and thus a way to evade taxes. RJR Nabisco was bought in 1988 for $25 billion, borrowed against the company assets. Servicing this debt ate up all its profit, which reduced its $682 million 1987 tax bill to less than zero in 1988. So there were no dividends to shareholders. The company was still sending out about the same amount of money to investors, but by calling it "interest" instead of "dividends" they saved hundreds of millions in taxes. Everyone was happy, except for the government who got less tax revenue on pretty much the same business, the 2,300 employees who were promptly laid off to trim costs, and the crippled Del Monte division, sold off in pieces to raise cash.

What's the point of dredging all this up? Just this: Rhode Island's current fiscal crisis is largely one that was chosen for us. Some of the choices were made in Washington, while others were made on Smith Hill. A tax policy that raises taxes on people who spend most of their money and lowers taxes on people who save is a recipe for recession and that's exactly what our state government has chosen, time and again. This is hardly all. We've chosen dozens of other policies that seemed designed to make our economy worse, from de-funding higher education to extravagant highway investments that provide only tiny improvements to travel times.

But through it all there is one constant. It seems there will always be economists, pundits and politicians willing to tell you that our economic condition is some kind of act of God, that international competition, deteriorating conditions for manufacturing, and declining real wages are as inevitable as the tides. Certainly some economic phenomena are beyond our control, but the events I describe here were all conscious policy choices. Elections matter, and this is why.

19:06 - 11 Sep 2009 [/y9/cols]

From here:

It still rankles -- a lot -- that Osama bin Laden is still out there. When the attacks happened, and in the days and weeks that followed, lots of notions flew through my mind, most of them wild and fanciful or flat-out insane. But it genuinely never occurred to me to that the main architect of the attacks would still be at large eight years later.

Once again, what matters is not what politicians say, but what government does.

15:27 - 11 Sep 2009 [/y9/se]

Fri, 04 Sep 2009

Each year the Ocean Conservancy holds its International Coastal Cleanup on the third Saturday in September. Tens of thousands of volunteers will spend that morning picking up trash along the shore. In Rhode Island, there are dozens of cleanups around the Bay and some inland, too (there's one at Lincoln Woods). There's probably one near you. Last year volunteers picked up 8,354 plastic bags, 14,490 food containers, and 47,905 cigarette butts and I'm afraid there's plenty more out there.. This year, the conservancy is highlighting the risks to wildlife of discarded fishing line, which we find in great profusion (2,718 pieces picked up last year).

Call the Audubon Society at 949-5454 to find a location where you can help. Since it's the 21st century and we may as well make the most of it, you can also go online at signuptocleanup.org where you'll find a cool Google maps application that will let you find the cleanup nearest you, or the most scenic. If you're near Wickford, come help me clean up the harbor -- I'm "captain" there. Please RSVP at the phone number or web site, so we know how many people to expect.

13:08 - 04 Sep 2009 [/y9/se]

September is upon us, summer is drawing to a close, and after a two-month respite, the state budget debacle is about to begin exactly where it had left off. There are a couple of reasons to be as discouraged as ever, I'm afraid.

I'm not talking about the Governor's plan to slash still more aid to cities and towns and force state employees to take furlough days, and now layoffs. This is a shortsighted and counterproductive solution to our problems -- and it's appalling to be giving tax cuts to rich people at the same time -- but it's hardly a surprise. That is, this was all in the cards as soon as the legislature approved a budget with $68 million in unspecified cuts last June. What did they think he was going to do? Scrape off the gold leaf from his office ceiling and pawn it?

What's more discouraging than this, though, is a report out from the Rhode Island Public Expenditure Council and the United Way (summary, report). The report is the product of a commission of academics, business types, labor and activists that is supposed to be examining the collection of programs that make up the "safety net." It's not what's in the report that's discouraging; it's the report itself.

It starts from a good premise: the social services provided by the state do not constitute a "system" in any sensible meaning of that word. Poor people who need help have to file multiple applications for the different kinds of aid for which they're eligible and help is not continuous as a family's circumstances change. That is, a few more hours of work a week can make a family ineligible for aid worth much more than the extra wages. These are real problems that cost the state real money and have real consequences to families who need help. They have also been neglected for years, so it's nice to see them highlighted in a high-profile report.

But after identifying the problem, what to do? The report is, so far as I can tell, silent. Without that, it is without a point, just a useful description of the services available, with a collection of odd factoids about our state's spending on social services. I learned, for example, that we are first in the nation in the number of eligible families who don't get food stamps, and that we charge poor people who share the cost of Medicaid coverage more than any other state in New England (80% more). I see that the number of poor people getting cash assistance has been cut in half since 2006 while the number of unemployed people getting cash assistance has tripled since 2007. Ok, fine, but so what? Which of these numbers illustrates the problem of an unsystematic system? Which one shows us a different approach would be possible? The report doesn't say.

Here's one of those factoids I learned: the state spends 46% of its budget on social services. This, of course, was the newspaper headline, and will be the source of the predictable gnashing and moaning for the coming year. But as I've written before, the 46% of the state's budget that goes to "Assistance, Grants and Benefits" is not all social safety net spending, and less than a quarter of it is state tax money. Still...

Step back a minute, though. Why is so much of the state budget safety net spending? A huge amount of that is federal money that passes through the state budget. Food stamps, for example, are completely funded by the Department of Agriculture. Federal funds make up much more than half of welfare cash payments, Medicaid, and child care. But the federal government also spends money here on the Navy, the Coast Guard, Medicare, Social Security, air traffic control, and much more and none of that money goes through the state budget. Why do programs for poor people go through the budget while these others don't?

The answer is that state control over welfare programs was the price that conservative southern Democratic congressmen extracted from Franklin Roosevelt and Harry Truman in exchange for supporting these new programs. Adam Clayton Powell, then the lone African-American representative, would routinely propose anti-discrimination riders to these bills, which would routinely be voted down by northern Democrats who wanted their bills to be supported by southern Democrats.

So you can be sure we'll be hearing more of that 46% number in the coming months. But remember that it's little more than a remnant of an embarrassing time in our nation's history (and the Democratic party's history). The number itself means very little. When someone objects to it, ask what they'd do differently, just as I am today asking the authors of the RIPEC/United Way safety net report.

13:07 - 04 Sep 2009 [/y9/cols]

Thu, 03 Sep 2009

High speed rail: a boondoggle?

Or is the real boondoggle something else entirely. Read here.

17:19 - 03 Sep 2009 [/y9/se]