What's this? A Book!

Or buy here: Light Publications, Powell's, or Bn, Amazon A look at the lousy situation Rhode Island is in, how we got here, and how we might be able to get out. Featuring

Now at bookstores near you, or buy it with the button above ($14, or $18 with shipping and sales tax). Contact information below if you'd like to schedule a book-related event, like a possibly entertaining talk on the book's subjects, featuring the famous mystery graph. Join the RIPR Mailing List! For a weekly column and (a few) other items of interest, click here or send an email to ripr-list-subscribe@whatcheer.net. RIPR is a (paper) newsletter and a weekly column appearing in ten of Rhode Island's finer newspapers. The goal is to look at local, state and federal policy issues that affect life here in the Ocean State, concentrating on action, not intentions or talk. If you'd like to help, please contribute an item, suggest an issue topic, or buy a subscription. If you can, buy two or three (subscribe here). Search this siteAvailable Back Issues:

Subscription information:

Contact:For those of you who can read english and understand it, the following is an email address you are welcome to use. If you are a web bot, we hope you can't understand it, and that's the point of writing it this way. editor at whatcheer dot net Archive:

AboutThe Rhode Island Policy Reporter is an independent news source that specializes in the technical issues of public policy that matter so much to all our lives, but that also tend not to be reported very well or even at all. The publication is owned and operated by Tom Sgouros, who has written all the text you'll find on this site, except for the articles with actual bylines. Responsibility: |

Sun, 30 Dec 2007

Read here for a analysis better than I can write, of why I find the rhetoric of Barack Obama so problematic. I don't want someone who will seek reconciliation. I want to line up behind leaders who will, as David Addington (Dick Cheney's aide) put it so memorably, "Push and push and push until some larger force makes us stop."

00:47 - 30 Dec 2007 [/y7/de]

Thu, 27 Dec 2007

You might enjoy Despotism, from Encyclopedia Britannica films (1946). Did you know that progressive taxation is a defense of freedom?

22:37 - 27 Dec 2007 [/y7/de]

Check out footnoted.org, whose editor spends her time reading the footnotes of corporate filings. Listen to her on Marketplace.

20:01 - 27 Dec 2007 [/y7/de]

Wed, 26 Dec 2007

Why should you worry about welfare?

[Appeared last week in the Woonsocket Call, Pawtucket Times and other fine RIMG papers.]

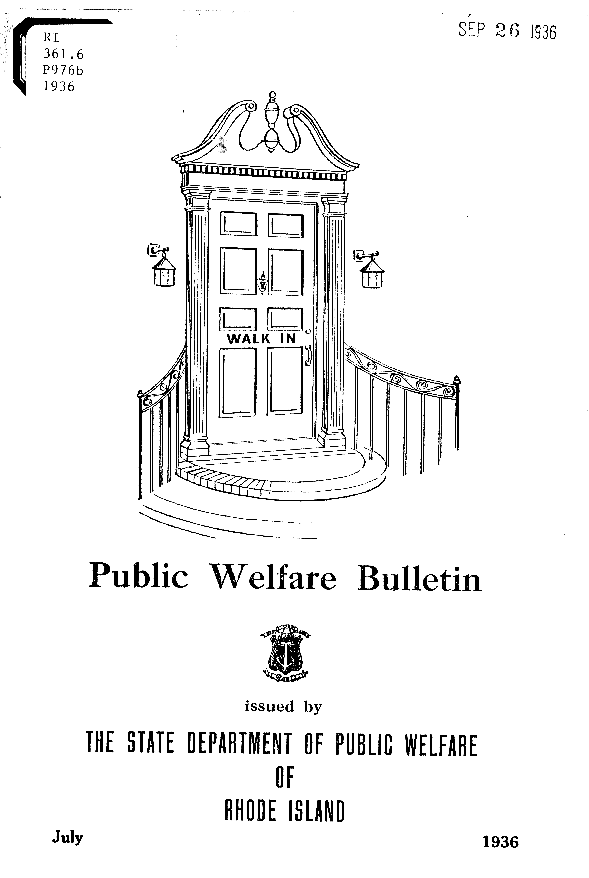

While browsing through old reports at the state house library a while back, I found the 1936 report of the state's Public Welfare Department. The report was interesting, but it was the cover that caught my attention. It's a fascinating image, but what's most fascinating about it is how incongruous it seems in 2007. Just try to imagine some meeting next year of the newly reorganized Human Services directorate, where an artist proposes this as a cover for their first annual report. When the laughter finally subsides, the new director will lean over and, with teeth clenched, inform the artist that meetings are not for drollery.

But what, exactly, is so strange about it? I spent a little while with my friend Google, browsing welfare department (ahem, "Human Services") logos in various states and cities. What you find these days is lots of little stick figures representing, I suppose, the people such departments are intended to help. (Check out whatcheer.net to see some.) Another way to say it is that they represent someone else. What's different about the 1936 drawing is that it seems to imply that the person who might need help is *you*.

[You can see the old logo, and some newer ones, below.]

Jacob Hacker, who teaches political science at Yale, wrote a book last year called "The Great Risk Shift." In it, he proposes that the most significant public policy changes over the past 30 years have been those that forced us all to assume more risk in our lives than our parents. Long-term employment contracts went out with the original VW bug; fixed-rate mortgages have been supplanted by floating rates; and pensions, when they exist at all, are no longer guaranteed income, but 401(k)s, where your pension depends on how astute an investor you were.

The truth is that we live in a more uncertain world than a generation ago and these days, many of us are in a position where a serious illness, an accident or untimely death, a layoff or a divorce could throw their family's finances into a tailspin. Maybe that's why bankruptcies are up 600% since 1980.

Hacker uses evidence from newspapers and survey data to make his case. I have another source. We've all heard about the people who have been on welfare for years. The Governor wants you to be mad at them, even though most of them are too young to drive. But what about all the others? These are people who need the program for a while, and then they're over their crisis, or their children grow more independent, and then they get off.

I spent a little time this week with the results of a five-year study headed by Mary Ann Bromley, a professor at Rhode Island College. That study interviewed 638 people receiving cash welfare benefits in 1998 and 1999, and then again a few years later, to see how they were doing. The results are interesting, and quite complicated, but the basic story is pretty clear. Five years after they were receiving welfare, 55% of the study participants were happily employed. Another 23% had been off welfare, but had been forced back on -- usually by the loss of a job or by a medical crisis.

With that in mind, I went back to the DHS annual welfare reports and did some figuring. There are fewer than 10,000 families on welfare now, and compared to around 400,000 households in the state, that seems like a small number. But according to the reports and my rough calculations, over the past decade or so, it seems that more than 60,000 families -- upwards of 160,000 adults and children -- have received cash welfare benefits from the state. We don't help much (the benefit amount hasn't been increased since 1989) but we spread the help wider than most people think.

Stand in the grocery store next time you're there, and look around. It's likely you'll see no one who is on welfare right this very moment, since only about one out of every 35 of us is receiving benefits. But if there are more than seven or eight customers, you will almost certainly see at least one person who has been on welfare at one point, and is now doing fine. These people live in the city and they live in the suburbs. They are your neighbors, and they might even be you. And that's the point.

So here's the real tragedy here. We have a social problem, which is the real increase in risk and uncertainty in most people's lives over the past 25 years. And we have a government that is in a position to allay the problem. Income supports, health care, pensions and child care are all services happily (and cheaply) provided by governments in dozens of other countries, in Europe and around the world. But the position of the people we've elected to run our various governments is that we can't learn from those countries, and that government can no longer even try to solve the problems that only it can solve. Is that how you want your state run? With a padlock on the door?

14:28 - 26 Dec 2007 [/y7/cols]

Another sign of our world-class health care system

It seems that the incidence of worms among inner-city residents is startlingly high and on the rise:

WASHINGTON (Reuters) - Roundworms may infect close to a quarter of inner city black children, tapeworms are the leading cause of seizures among U.S. Hispanics and other parasitic diseases associated with poor countries are also affecting Americans, a U.S. expert said on Tuesday.Recent studies show many of the poorest Americans living in the United States carry some of the same parasitic infections that affect the poor in Africa, Asia, and Latin America, said Dr. Peter Hotez, a tropical disease expert at George Washington University and editor-in-chief of the Public Library of Science journal PLoS Neglected Tropical Diseases.

I especially liked this part:

He noted a recent study by the Centers for Disease Control and Prevention, presented in November, found that almost 14 percent of the U.S. population is infected with Toxocara roundworms, which dogs and cats can pass to people."Urban playgrounds in the United States have recently been shown to be a particularly rich source of Toxocara eggs and inner-city children are at high risk of acquiring the infection," Hotez wrote, adding that this might be partly behind the rise in asthma cases in the country. Up to 23 percent of urban black children may be infected, he said.

14:20 - 26 Dec 2007 [/y7/de]

Fri, 21 Dec 2007

How long before this gets blamed on Clinton?

Read here.

13:52 - 21 Dec 2007 [/y7/de]

Thu, 20 Dec 2007

Several papers where my column was printed this week omitted this image, the cover of the annual welfare department report from 1936:

More modern welfare logos, from around the nets:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

21:46 - 20 Dec 2007 [/y7/de]

Pedestrians are second-class citizens

Two pedestrians were killed yesterday because there was nowhere for them to walk besides the streets.

I read this somewhere:

To be a pedestrian in Rhode Island is to be a second-class citizen, constantly reminded that you are less important than citizens who drive.

Oh, yeah. here or here (See p. 12.)

On the brighter side, my bus driver was handing out cookies this morning.

Read a little more after the jump.

There are some common experiences to trying to get around Rhode Island on foot. Traveling without a car in Rhode Island means committing to scrambling over berms and guard rails between bus stops and destinations, walking across four-lane streets with no crosswalks, wading across marshy median strips, climbing over unplowed sidewalks, and more. Bus stops are out by the road, with gargantuan parking lots to trek across before you get to the store. Standing next to the road in inclement weather means getting wet from drivers passing four feet away at forty miles an hour, and crossing the street means matching wits with aloof and occasionally hostile drivers. And there is not a "walk" button in the state that perceptibly changes the light when you press it.

Bringing these experiences to officials' attention is rarely productive. One is told that too few people walk to make it important (the very definition of a self-fulfilling prophecy) or that slowing down the traffic would make "people" wait, as if the pedestrians do not qualify as people. Putting in additional crosswalks is thought to create unnecessary traffic tie-ups and even though municipal comprehensive plans may require commercial buildings to be next to the sidewalk, and therefore convenient to pedestrians, planning commissions and town councils seldom insist on these kinds of restrictions, and regularly trade them away for other amenities.. After all, few of them walk. In other words, to be a pedestrian in Rhode Island is to be a second-class citizen, constantly reminded that your safety and comfort are rated far behind those of your fellow citizens in cars.

09:17 - 20 Dec 2007 [/y7/de]

Tue, 18 Dec 2007

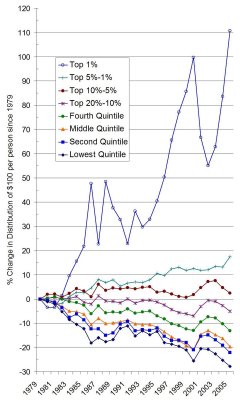

Here's an exciting graph, made here. This is the change in income share for various different sections of the population since 1979. You'll see that the top 1% of income earners did pretty well. How'd your neighborhood do?

See the link for all the details.

14:45 - 18 Dec 2007 [/y7/de]

Received this from the Treasurer's Office:

FYI. Rhode Islandís pension system is one of the most underfunded in the United States, in aggregate terms, according to a study by the Pew Charitable Trusts released today. Rhode Island requires a higher contribution from state employees (8.75% of salary) to participate in the pension system than all but two other states....

You can see the rest here and the full report.

The state employee pension fund (which also covers teachers) is indeed underfunded, but determining how fast we need to fix that is a source of contention. Were one to ask Treasurer Mollis why, if the underfunding is such a crisis, he doesn't demand that we pay off the unfunded liability next year. He'll say that's crazy talk, thereby making my point (made here and here and here and here) that reasonable people can differ about how fast it should be paid off.

The fact remains that Rhode Island is on a very aggressive schedule of repayments, and this costs us a lot of money to be more fiscally responsible than anyone requires us to be. If "fiscal responsibility" simply means spending your dollars wisely, then Rhode Island's citizens should know that a trade-off is being made in their names in favor of what banks call fiscal responsibility and against what other observers — the ones who notice the long-term costs of slashing education spending, for example — might also call fiscal responsibility.

11:50 - 18 Dec 2007 [/y7/de]

[Appeared last week in the Woonsocket Call, the Pawtucket Times and other fine RIMG papers.]

An interesting fall: One week we open a stylish new bridge, and the next week, one of the most important bridges in the state is found to be unsafe for anything as heavy as, say, a truck. The Department of Transportation says they can't afford to fix the I-95 bridge in Pawtucket any time soon. But it would be cheap to build in a slightly greater upslope on either side of the bridge. That way, you can gun your engine as you approach the bridge, and soar across the weakened span without having to worry about whether there is more rust or steel beneath your wheels. Detours are for sissies.

But wait a minute. It can't just be cost, because at the same time DOT says they can't do anything about the Pawtucket Bridge, they just finished a new bridge in Providence and they're about to begin construction on a replacement for the Sakonnet River Bridge. They have money for new construction, but not for repairs?

As usual, we're at the end of a tale that only makes sense when you begin at the beginning. So here it is: sometime back in the 1970's -- it's a little hard to be precise from the documents I've seen -- the Assembly and the Governor decided to borrow several million dollars, not for any specific project, but just to keep the rivers of federal highway money flowing down the corridors of the state house. The interstate highways were almost done, and who'd want to dam that torrent? That money required a state match, and, well, why not borrow to match it?

Of course borrowed money isn't free, and you do have to pay it back, with interest. They borrowed it anyway, and simply took the interest payments out of the maintenance budget, and no one was the wiser. This created a budget hole, but who would miss a year's worth of bridge-painting? Besides, it's more fun to ask for a bond issue to build a bunch of new stuff than it is to admit to the House Finance chair that you're over budget.

But the next year the budget hole was still there, and the additional debt service only made it deeper. Unfortunately, no one had the guts to say this was a problem, that year, or the next, or any year since. As long as DOT could keep borrowing and new roads keep getting built, then everyone was happy, even if the maintenance situation got worse each year. And now the detour signs in Pawtucket tell you how bad it is.

In fact, the debt problem is so bad that a few years ago, those debt payments were moved out of DOT's budget and into the Department of Administration. This was a meaningless accounting change, but again it avoided the shame of having to admit they were spending way beyond their means. This coming year, DOT will borrow about $40 million, just about the same amount they pay in debt service. Does it sound like using one credit card to pay the minimum balance on another? It is. Other states don't borrow like we do; they reserve borrowing for special big projects, not the routine stuff we use it for here.

This is a crazy way to run the state's finances, and I haven't even gotten to the hundreds of millions in off-books, no-referendum borrowing of the past three years and the resulting $49 million in additional debt payments this year. The cost of DOT borrowing is a major contributor to the disaster of our state budget, but the blame is shared so widely that no one wants to talk about it because who could they accuse?

Another legacy of these bad decisions is that we don't fix roads and bridges; we replace them, since you can get federal money for new construction, but not maintenance. The old Jamestown Bridge didn't have the capacity of the new bridge, but its replacement was dictated by department finances, as much as by anything else. They didn't have money to do anything else. The current DOT Chief Engineer has already spoken about "replacing" the Pawtucket bridge. The grand new I-boondoggle over the Providence River, which will cost us upwards of $610 million before it's done, was originally proposed as a $150 million alternative to $50 million in bridge repairs. (In what I'm sure is nothing more than an alarming coincidence, the Sakonnet River Bridge replacement project is now said to be a $144 million alternative to $70 million in repairs.)

As the experience of tens of thousands of drivers can already attest, the I-boondoggle will do just about nothing to improve traffic, but by the time we count all the debt service, we'll have spent around a billion dollars on it. That's about one entire year's worth of state income taxes, in case you're wondering. DOT doesn't want you to think of that when you're next stuck in traffic there, and that's why they've paid almost $200,000 to the Providence PR firm, Duffy and Shanley, whose job it is to make you think about the bridge's stylish design instead. And it is stylish, isn't it?

The Governor doesn't want you to think about wrong-headed billion-dollar spending decisions, either. He wants you to ignore those little details and blame the state budget crisis on welfare recipients and interpreters on the state payroll. Will we let him?

11:11 - 18 Dec 2007 [/y7/cols]

Thu, 13 Dec 2007

What a falling market looks like

In California, prices flew higher than here, by a lot, but the basic shape of the real estate price record was roughly the same: crazy run-up of prices, unsustainable, and not supported by real people, but by speculators. Now look here to see what it looks like on the Stockton Magical Mystery Repo tour.

Via K. Drum.

13:07 - 13 Dec 2007 [/y7/de]

Tax policy in Rhode Island is a game played largely in the dark. There has been very little data available about taxes the state collects and even less analysis of that data. The state budget has never contained a full accounting of the taxes we collect, for example, and it contained no accounting at all of the gas tax.

But a hazy light has appeared on the horizon, and the tax division and House Finance have cooperated on a new publication, Revenue Facts. This was apparently put out last month, but I missed the announcement party, I guess.

The first issue has some rough spots (a table on page 135 seems to be missing about 400,000 taxpayers, for example), but it is a vast step forward from what we have had. Happy holidays to all you little data elves.

Update: The table has been fixed.

08:22 - 13 Dec 2007 [/y7/de]

Mon, 10 Dec 2007

[Appeared last week in the Woonsocket Call, the Pawtucket Times, and other fine RIMG papers.]

Last week the state Public Utilities Commission (PUC) voted not to change its rules about gas and electric shutoffs if you don't pay your bill, and rules about getting it turned back on. The PUC had been considering a minimum payment required to get your electricity turned back on, as well as new rules about who could be represented by whom at shutoff hearings, but they decided against it.

In any discussion of utility shutoffs, there is a question lingering in the back of people's heads. It was all over mine, so I'll be the one to admit it: why should I care? If someone can't pay their bill, then how is that different from ordering food at a restaurant without money in your pocket?

Here's why: nobody means to go to Burger King and accidentally winds up in the Capital Grille. And there's no lease or mortgage on your table even if you do, so you can leave if you need to. We have a world where it's easy to get into trouble, but hard to get out. Someone can get sick or laid off, or the price of energy can just shoot through their roof. Fuel prices have shot up by a third since this time last year, and it shows up in utility bills.

Meanwhile, the condition of the real estate market has made it so that even if you realize you're in a too-expensive-to-heat house, there may not be anything you can do about it. You're behind on your heating bill, but selling your house at a depressed price will mean financial ruin. Sounds like an easy choice, right? Maybe that's why 29,970 people had their electricity or gas shut off during the first ten months of this year. That's a record, up 18% since one year ago.

State law protects the very poor, elderly and disabled from having their utilities shut off between November and April, but that only means a reprieve of a few months, and it still leaves a few thousand people in the lurch. As of November 16, National Grid reports that 2,814 gas customers and 1,309 electric customers had their service shut off.

When I hear numbers like these, I can't help but also notice that Exxon Mobil's profits are down to only $9.4 billion this past quarter, down from $10.5 billion a year before. In fact, oil companies are currently so profitable that stocks like Exxon are propping up the Dow Jones average, even while the other blue chip and bank stocks slide down and down. And then there's National Grid, the energy conglomerate that now provides most of our state's electricity and natural gas.

It's difficult to tell from their filings what National Grid earns from Rhode Island, but there is no mistaking that it is a very profitable enterprise. In the first six months of this year, their financial statements show they earned a profit of $1.2 billion on revenue of only $3.2 billion on their electric transmission business alone. (About $152 million of profit that was from US operations.) This is a huge profit margin in any business, and is up 17% since last year.

A part of your electric rate is dedicated to bills that will likely never be paid off. According to the PUC attorney, this is about 1% of your electric bill, which covers a substantial part of the losses. But why this should come out of your bill at all is something that has never been adequately explained to me. This is, of course, the way things work with regulated private utilities, so what can you do?

As it happens, our state contains its very own counter-example. The Pascoag Utility District provides power to about 5,000 residents of Burrillville, and is owned by those very same residents. Pascoag isn't a particularly poor place, but like all our towns, they have some poor people. And no town is immune from illness, divorce and layoffs. But as of November 16, they had zero ratepayers cut off for non-payment of their bill. Plus their rates are lower. (Or they will be after National Grid's proposed 5% rate hike in January.)

I asked Judy Allaire, their deputy general manager about all this, and she told me there were plenty who were cut off over the summer, but that they were mostly people who had fallen into some temporary bad situation and that they'd worked out payment plans with each of them. She told me, "We're smaller, so we know our customers and we know when they're getting into trouble and can help them get out." Pascoag can do things that National Grid can't, partly because they're smaller, and partly just because there are no shareholders demanding their investment returns.

Decades ago, our nation decided that regulating private utilities was better than trying to own and run them. Over the years, this has created these strange situations where you have public bodies like the PUC guaranteeing the profits of private investors. The system does appear to work, after a fashion -- people get their electricity and the investors get their profits -- but right here in Rhode Island, next to the huge for-profit utility is a little municipally-owned enterprise that gives better service for less money. Markets are fine things, but we shouldn't let them blind us to other possibilities for organizing government services. Like health insurance, for example. For most of the knotty policy problems facing us and our government, open minds are what we need to get the job done.

21:57 - 10 Dec 2007 [/y7/cols]

Sun, 09 Dec 2007

What's the good of an opposition party if it won't oppose?

22:56 - 09 Dec 2007 [/y7/de]

Sat, 08 Dec 2007

This is a very bad sign. The dollar's value is plummeting, and it will continue to plummet, so long as we have nothing the world wants to buy. Until recently, about the only thing we had that people wanted were financial assets. Foreign nations would sell us stuff and accept our dollars because they could re-invest them in US securities that would earn money, or because they could use the dollars to buy dollar-denominated goods from other countries. This last was mostly oil.

Well, no one wants to buy our financial assets this week, and now dollars won't get you any Iranian crude, either. There is very little incentive for the other oil-producing states to accept dollars, except to the extent that their wealth relies on US investments. This probably means that Saudi Arabia and Kuwait will not eagerly follow suit, but what about Venezuela, Indonesia, Norway and Libya? What have they got to lose?

Expect imported goods -- including oil -- to get a lot more expensive soon.

Oh, and congratulations to all the people who think that international power flows only from military might. You've got your wish, and US foreign policy has been conducted over the past 7 years as if guns and planes are the only thing that makes us powerful. But this is only an adolescent fantasy put forward by people who look good in suits, and so are thought to be Very Serious People. We are about to see it unmasked. Stay tuned.

The reality is that our power in the world derives from the strength of our economy, the value of our financial assets, the value of dollars in international markets, the fact that people from all over the world want to come here, and more such intangibles. As we chip away at each of these, we shouldn't be surprised as we lose power.

14:31 - 08 Dec 2007 [/y7/de]

Fri, 07 Dec 2007

I found this to be a pretty entertaining look at the reality of the global economy. Here's part:

"I was thinking about this the other day. I was walking to work and I wanted to listen to the news so I popped into this Radio Shack to buy a radio. I found this cute little green radio for 4 dollars and 99 cents. I was standing there in line to buy this radio and I was wondering how $4.99 could possibly capture the costs of making this radio and getting it to my hands. The metal was probably mined in South Africa, the petroleum was probably drilled in Iraq, the plastics were probably produced in China, and maybe the whole thing was assembled by some 15 year old in a maquiladora in Mexico. $4.99 wouldn't even pay the rent for the shelf space it occupied until I came along, let alone part of the staff guy's salary that helped me pick it out, or the multiple ocean cruises and truck rides pieces of this radio went on. That's how I realized, I didn't pay for the radio."Who did? The people who lost their natural resource base, factory workers, those who are made sick from factory pollution, and retail workers without health insurance.

16:12 - 07 Dec 2007 [/y7/de]

Tue, 04 Dec 2007

A fine new resource for the curious

Introducing WikiLeaks.

You'll want to use it to check out the leaked Guantanamo procedures manual, or rather the changes to the manual 2003-2004. Did you know that violating the Geneva Conventions was still SOP in 2004?

Remember, policy is what government does to you. That's why the important stuff is always squirrelled away in long reports and dense statistics.

15:14 - 04 Dec 2007 [/y7/de]

[Appeared last week in the Woonsocket Call and Pawtucket Times and other fine RIMG papers.]

All the leaves are brown and the sky is grey, and I have Governor Carcieri's staff reduction plans to evaluate. We finally learned last week that the Governor's proposed job cuts will not all be in invisible "back office" positions. It turns out that he's not only talking about middle managers, but about front-line state employees: translators, janitors, cooks, nurses, social workers and many more.

As you look over the list, you do get the feeling that many of these jobs are, indeed, overdue for reconsideration. Why, for example, does the taxation division need both a Director and an Executive Administrator? The Director is on the chopping block, and perhaps that's just as well.

On the other hand, reading the list also tells you that the $41 million in savings the Governor is claiming simply won't happen. I see several lawyers in Human Services (DHS) who are due to be cut. Will anyone bet against me that those salaries won't be replaced by payments to $300-an-hour law firms? We've also heard about the Cambodian, Hmong and Portuguese translators to be laid off from DHS. But Hmong speakers are still going to come to DHS for help, and someone is going to have to translate for them. The Governor's proposal is to rely on those people's children, but it's hard to imagine that no money will be spent on translation services.

On the list I also see what seems like the entire kitchen staff at Zambarano and Eleanor Slater Hospitals. Oddly, this sounds just like the (unsuccessful) proposal he made earlier this year to privatize those services. You may think this is a good idea, or you may not, but either way, you have to be skeptical of anyone who claimed all their salaries as savings. Does the Governor imagine that some private contractor will cook for the state's patients for free? If he does, it might explain why he's so enthusiastic about privatizing services. I hope someone breaks it to him gently.

The truth is that privatizing is not a sure-fire way to cut costs. Contractors are sometimes cheaper than state employees, but not always, and there are frequently significant costs to contracting that never get counted. DHS is on the hook for about $5 million a year to Northrop Grumman these days because years ago the department made a choice to rely on contractors to maintain the computer system that pays state welfare checks. The system was written in an obscure database language, and Northrop now has most of the remaining experts in that language on their staff, so we are stuck with them until we ditch the whole thing. Had we made a different decision back then, we'd be paying far less to maintain the system today.

There are other problems, too. Rising pension payments are one of the real problems in state and local budgets. Several hundred fewer people paying into the system isn't going to make it cheaper for those who remain. And we haven't even gotten to the bumping and seniority issues. We are facing a $400 million deficit next year, and the Governor offers us a $41 million cut that is really just a fraction of that. He says he'll make it add to $100 million with cuts in employee benefits, but so far it seem like just budgetary dreamin'.

Where will the balance come from? Not taxes, or so says Carcieri. In speeches and interviews lately, he's been making much of "those who would raise your taxes." But who are these unnamed people? The Poverty Institute, not exactly a power center, but probably the most prominent statewide advocacy group for social services, is this year only proposing rolling back a couple of the tax cuts granted over the last few years. I've heard no member of the General Assembly speak in favor of raising taxes, and to the amazement of those with fingers to count on, the Assembly leadership remains committed -- at least in public -- to cutting taxes on the rich even more. As I've written before, I happen to think it would be a dandy idea to address some of the injustices perpetrated by the last few years of tax cuts for the rich and tax hikes for everyone else, so maybe he means me.

If so, it's kind of flattering, really, but who knew responsibility could be so lonely? The crazy thing about the state budget crisis these days is that it sometimes seems like there is no one on the side of paying for state services with, you know, revenues. Once upon a time, this was thought to be a hallmark of serious discussion about government, but in our modern tax-cut-happy world, that kind of talk is simply not the done thing.

The Governor is right about one thing: There really is a dark and malignant force moving stealthily across the political landscape this year. A spectre is haunting Rhode Island -- the spectre of arithmetic. Eventually, he and the Assembly are going to have to make things add up. Let's all hope for a bit less dreaming when that day comes.

15:05 - 04 Dec 2007 [/y7/cols]