What's this? A Book!

Or buy here: Light Publications, Powell's, or Bn, Amazon A look at the lousy situation Rhode Island is in, how we got here, and how we might be able to get out. Featuring

Now at bookstores near you, or buy it with the button above ($14, or $18 with shipping and sales tax). Contact information below if you'd like to schedule a book-related event, like a possibly entertaining talk on the book's subjects, featuring the famous mystery graph. Join the RIPR Mailing List! For a weekly column and (a few) other items of interest, click here or send an email to ripr-list-subscribe@whatcheer.net. RIPR is a (paper) newsletter and a weekly column appearing in ten of Rhode Island's finer newspapers. The goal is to look at local, state and federal policy issues that affect life here in the Ocean State, concentrating on action, not intentions or talk. If you'd like to help, please contribute an item, suggest an issue topic, or buy a subscription. If you can, buy two or three (subscribe here). Search this siteAvailable Back Issues:

Subscription information:

Contact:For those of you who can read english and understand it, the following is an email address you are welcome to use. If you are a web bot, we hope you can't understand it, and that's the point of writing it this way. editor at whatcheer dot net Archive:

AboutThe Rhode Island Policy Reporter is an independent news source that specializes in the technical issues of public policy that matter so much to all our lives, but that also tend not to be reported very well or even at all. The publication is owned and operated by Tom Sgouros, who has written all the text you'll find on this site, except for the articles with actual bylines. Responsibility: |

Tue, 28 Apr 2009

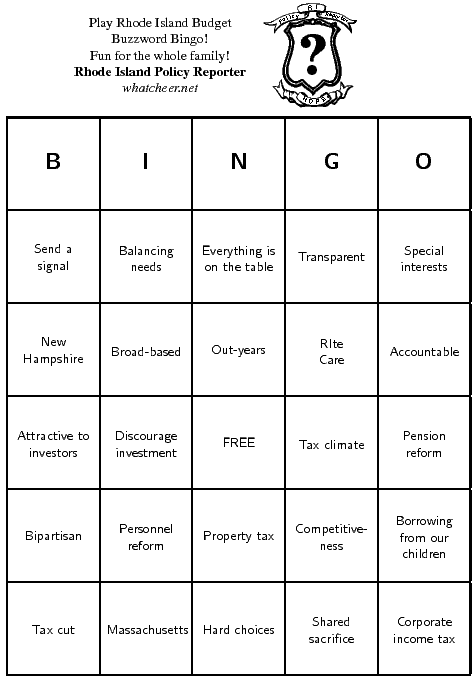

Fun for the whole family! Click on the card for details!

10:35 - 28 Apr 2009 [/y9/ap]

Sat, 25 Apr 2009

Good news from the front, sort of

The annual fact book is out from Rhode Island Kids Count. This is sort of an almanac of child welfare, and covers everything from the number of kids in day care to the number of homeless children to the number who drop out from high school. (You can get the book yourself at rikidscount.org.) This week I'd like to focus on some of the good news, sort of.

Public school test scores are up. Did you know that? Fourth and eighth-grade reading and math scores are up in the last few years, both by the NECAP (RI, NH, VT) and the NAEP (national) tests. So celebrate!

In a way this is not terribly surprising. Education policy in our state (and nation) has become so focused on test test test TEST! that it would be shocking if there were not some positive result. I don't think many people without children in the schools are really aware of how many tests there are, and how much time is wasted on them. Gathering good data is important, and it's how public enterprises should be evaluated, but entire weeks of the school year are lost to testing, which is plainly ridiculous. Honestly, it's little more than a symptom of the mass hysteria about public education we suffer, and I and my children are more than ready for that ol' pendulum to swing back the other way a little bit.

The data also show a steep drop in graduation rates, and those of us who notice what an intrusion into the school year the current infatuation with testing has created can't help ponder if it's related. Surely some children must wonder if they're students or merely test subjects. Of course, we're also seeing a precipitous decline in school age children in our state, and the decline in graduation rates may be a consequence of that instead. A child who leaves the state with his or her family won't graduate from high school here.

So in response to this (mostly) good news, it seems that we're poised to close schools, slash school staff across the state, shutter sports programs, fire music teachers. That will surely help.

A statehouse insider who is intimately involved in budget deliberations (and who will go unnamed only because it was someone else's meeting I was horning in on) recently complained to me that Rhode Island pays more and gets less for its education dollar than most other states. This idea, so far as I know, originated with some Rhode Island Public Expenditure Council reporting a dozen years ago or so, and it's one of the most pernicious factoids floating around the state. It's a too-easy analysis that has truly damaged our state.

The complaint is that we spend a lot per child in the schools, and yet our test scores lag our neighbor states. Massachusetts, for example, typically tops the lists of education achievement among states, while our scores hang around the basement. Massachusetts spends more per pupil, and pays its teachers better, but the achievement differences existed a while ago when the spending differences weren't as pronounced.

What of it? Are schools just factories? The wild romantic in me insists that an appreciation for the glories of human civilization is worth passing on to our children even if it has nothing to do with getting a job, but I'll calm down and let's consider the Thomas Gradgrind factory view of the matter.

To start with, let's talk about, um, raw materials. There is a considerable body of research (not to say common sense) that says early childhood education and living conditions can be a huge component of academic success. So what do we do? In Massachusetts, 67% of 3-5 year old children are in some kind of pre-school or kindergarten, while here it's around half. This is just part of the story. You can run down the whole list of child welfare indicators published by Kids Count, and you'll see the same thing. Percent of young children living in poverty? 13% in Massachusetts, 21% here. Births to teen mothers? 6% vs. 9%. Children in households headed by a high-school dropout? 9% vs. 13%. Even the child death rate is twice as high here (20 per 100,000) as there (10). Overall, Kids Count puts Massachusetts as the third-best place to be a kid in the country, while we're at 21. Is it conceivable that this has no effect on kids' school achievement?

Now let's talk about cost. We spend less than Massachusetts does on educating our children, but compared to our income, it's a bigger share. This is interesting, but is it relevant? Schools compete for teachers in a regional market. Someone hunting for a teaching job is as likely to apply in Massachusetts or Connecticut. Salaries have to be competitive if you want good candidates. Schools are not alone in this. Most private-sector white-collar jobs in Rhode Island have pay comparable to our neighbor states, but most blue-collar jobs pay quite a bit less. In other words, thousands of private employers -- almost none of whom were under any kind of union pressure -- have made precisely the same calculation as our schools about the appropriate level of pay for their employees. (Read more about this at issue 11.)

Here's the most important comparison I know about. Everyone knows Massachusetts has Proposition 2.5 to limit property taxes. But does everyone know how often those limits are overridden by local taxpayers? Between 1990 and 2005, 224 of Massachusetts 351 cities and towns voted to override the limits, some dozens of times. During that time, how many times have RI taxpayers outvoted a town council to increase a school budget?

What's the secret they know? Maybe they understand the strength of their economy is almost entirely due to education. Massachusetts is a much richer state than ours, but it's not the climate that makes the difference. Maybe it's just because they've chosen to invest in their children.

07:40 - 25 Apr 2009 [/y9/cols]

Thu, 23 Apr 2009

Issue 36 of the Rhode Island Policy Reporter is out:

- A review of "cap and trade," the plan to control global carbon dioxide emissions. Did you know we have lots of experience with plans like this? Some lessons from that experience.

- A closer look at the controversy over EFCA and secret ballot union elections. "Card-check" is not the provision large employers find most alarming, just the issue that polls better.

- Book review of the final report of the Governor's blue-ribbon commission on tax reform. Summary: hackneyed plot, but interesting conflict.

Didn't you mean to subscribe already? Subscription details here.

08:10 - 23 Apr 2009 [/y9/ap]

Wed, 22 Apr 2009

We get mail:

Dear RI Policy ReporterI was at the "Tea Party" you wrote about on April 15th. I had a Giant poster of a Tea cup, labeled "Iraq - One big cup of tea. Stop big spending! $660 billion of our tax money spent." Funny thing is I was not made very welcome and had -"support the troops" and other comments spoken or occasionally shouted at me - the most disturbing one was an older man, well past the age of military service that shouted that I "should be ashamed of myself?" I am confused, I though I was protesting big wasteful spending of tax money handed out to the politically favored. Were did I go wrong? Help me RI Policy Reporter.

Confused in Providence

Some people are just trouble makers.

08:32 - 22 Apr 2009 [/y9/ap]

Sun, 19 Apr 2009

Boston Tea Party a protest against corporate tax cuts

A funny piece points out that the East India Company was granted a huge tax break that threatened the livelihood of anyone in America who sold tea and that this was the real background to the tea party. Puts some of last week's tea-related festivities in perspective.

00:35 - 19 Apr 2009 [/y9/ap]

Here's a record of successful Prop 2½ override votes. It's an interesting list. Apparently summer communities do this pretty frequently, which is not terribly surprising. But some of the others aren't obvious candidates.

00:26 - 19 Apr 2009 [/y9/ap]

Sat, 18 Apr 2009

Last week was April 15, tax day. Celebrants gathered at the statehouse to applaud all the wonderful things your state and local governments do for you: pave your roads; educate your children; arrest, try and imprison criminals; put out fires; and keep poor people from dying in the streets. Because they are activists, they have taken the time to learn about some of the things your government does for you that don't always get a lot of attention: police insurance companies; deliver (and inspect) drinking water; maintain sewers; monitor beaches for water pollution; register vehicle and land titles; create and enforce land-use plans; provide care for long-term disabled people; run bus and train service; and much more.

Oh, sorry. Well a boy can dream, can't he? Actually, as anyone reading this well knows, the activists were at the statehouse yesterday not to applaud any of that, but to complain they wish it was cheaper. They brought tea bags with them, a cute touch meant to remind us of Sam Adams. The mystery, of course, is that they think there exist people who disagree. For example, I don't.

It's actually quite easy to come up with ways to run our goverment more efficiently and less expensively. But almost all the realistic ideas I know about -- reining in DOT debt, upgrading the DHS computer system, welfare application reform, and more -- require us to put in some money up front in order to save big in the future, and that kind of practical and intelligent planning has been effectively off the table in discussions of the RI budget since at least 1991, if not before.

Why is that kind of thing off the table? Well that brings us back to the anti-tax activists at the state house yesterday, doesn't it? Are they demanding "better" government or just "cheaper?"

Were you at the big tea-bag rally? Answer me this: what would you cut? Which function of government do you think we can do without? Which department of your town would you like to have run by less competent people? I'm not saying there aren't answers to questions like these, but I don't hear anything like an answer in clever slogans about taxes. I spoke a little bit with Colleen Conley, one of the tea bag organizers, and she was pretty much unable to recommend anything more than pension cuts, consolidation of municipal services and the lifting of state mandates on cities and towns.

Now I believe Conley is a sincere and honest person, trying to make a difference in an unjust world. She's trying, which is more than a lot of us do, and consequently I feel a little bad about what follows here. But it was specific policies that led our state into the debacle we now face, and you deserve to know who is promoting those policies and why.

The fact is that when we spoke, she didn't know some very basic facts about her own proposals, like how much any of them could save, or even about government spending. For example, if you're going to recommend that cuts in pension costs be used to balance our budget, it's worth knowing that our state's annual personnel costs are around $800 million, or less than a quarter of general revenue. The current budget deficit of somewhere around $400 million is almost half that, and two and a half times as large as all the pension payments we make each year. Trimming pension costs might help meet the budget goals, but it's not nearly enough.

These are not "gotcha" questions. These are basic facts relevant to the policy proposals promoted by the tea-baggers who are, after all, demanding that taxes be lowered still further. When I pressed her, she said that "groups from the left to the right" were coming to support the tea party, and that there is naturally some disagreement over what cuts should be, but they are united in demanding lower taxes. But if the group is too divided to say what it's for, then why should anyone listen?

But the "left" part isn't really true, either. Conley eventually cited a report from the American Legislative Exchange in support of her stances. ALEC is organized by conservatives with a "common belief in limited government, free markets, federalism, and individual liberty." (I'm quoting www.alec.org.) They give Rhode Island low marks for our high corporate income tax rate, without noting that 94% of RI corporations don't pay it. They also ding us for "recently legislated" tax hikes totaling about $70 million in 2007 and 2008. Do you remember that? I don't. What I do remember is pointing out in 2007 that the National Conference of State Legislators had mistakenly assumed a $70 million provision of tax legislation that gets re-authorized each year was a tax hike. (See below.)

In 2007 and 2008, we closed a couple of corporate loopholes and raised a whole bunch of fees, but we also cut taxes on wealthy individuals. The corporate loopholes are complicated and reasonable people can disagree about whether the net was positive or negative, but it sure wasn't a $70 million tax increase.

So not only is the tea-bag organizer not able to talk convincingly about spending cuts, but the organization relies on materials prepared by folks who can't tell the difference between tax cuts and tax hikes.

The real issue is this: Taxes are simple. Government is complicated. If you don't have an answer to the question of what is to be cut, perhaps you'd do us all a favor by spending some quality time with the state budget to figure something out before complaining about taxes. Rhode Island needs educated activists. What it does not need is more clamor in favor of the very policies that have delivered us to this sorry pass.

17:44 - 18 Apr 2009 [/y9/cols]

Sat, 11 Apr 2009

While debating the state budget last week, Senate Majority Leader Daniel Connors (D-Cumberland,Lincoln) said the budget "doesn't represent the hard choices we're going to have to make." He was apparently referring to the fact that the budget didn't cut enough. You hear this kind of talk about "hard choices" all the time. As if there's anything hard about sticking it to poor people and cities.

What's hard about it? Suburban legislators like Connors routinely get elected and re-elected by mouthing platitudes about hard choices, tsking piously about the problems of our cities, and by promising to get tough on unions. Legislators who vote for these things still get invited to good parties. They can still raise money for their re-elections and no one throws eggs at them when they speak in public. Life is good.

What's more, they routinely follow through on these promises, this year stripping cities and towns not only of the state aid promised them last June, but also most of the stimulus money promised by Congress and President Obama. In the last few years, the pensions and health benefits for state employees have been cut, teacher unions all across the state have given back health benefits, health care for poor people has been trimmed and cut and pruned. Did you know that the monthly cash benefit for welfare recipients is the same today as it was in 1989?

What provokes people to claim choices are hard is that occasionally they realize these policies may be popular, but are also shortsighted and, well, stupid.

Cutting expenses in the state and municipal budgets is hard for a lot of different reasons. Some expenses are enforceable in courts. These are not only labor contracts (whose enforceability is increasingly under question in Rhode Island), but also commitments to the federal government or to individual citizens. Special education laws, for example, have a thoroughly-worked out series of appeal possibilities that start with committees in a school and can go right up into federal courts. These appeal routes are well charted because the federal money for these federal mandates has never been enough to pay more than about 18% of the expenses. Local school districts have ample incentives to balk at the expenses, and parents have ample incentive to appeal the balking.

Another important reason cutting budgets is hard is because a lot of state policies exist to save money. Why do we give health care to poor people? Because overcrowded emergency rooms are more expensive. (Plus it ruins the feng shui of our cities to have people dying in the gutter.) Why do we have free public education? Because in terms of our economy, ignorance is more expensive. Why should we maintain the roads, bridges and properties we own? Because not doing the maintenance is far more expensive. All of these policies, and many more, exist because previous generations understood they were important as ways to save money.

So what happens when we don't do them? That's easy, things get more expensive and we don't save money. Bob Weygand, the VP of operations at URI, recently told the campus newspaper that the university has about $400 million in deferred maintenance: windows, roofs, and boilers that need fixing on existing buildings. That's almost an entire year of their operating budget, and more than five times what they get from the state every year, and it's grown a lot recently. According to a faculty gadfly I know, in 1995 the administration estimated the deferred maintenance at $55 million. Anyone who thinks that problem can be ignored year after year without consequences is dreaming.

The same thing is true in all of our public infrastructure. With your pinky finger you can dislodge hand-size chunks of cement and rusted iron from a bridge near my house. Inspectors come a couple of times a year to track its decay, but there is no prospect for its repair, even with the stimulus money from Washington. Other bridges are in worse shape. Big trucks can't even use the most important road in the state any more since the bridge is so rotted. We're replacing the Sakonnet Bridge because DOT engineers deem it too far gone to be worth repairing.

The choices are always presented as between raising taxes and cutting services, but it's childish to think it so simple. Your legislators face this choice: On the one hand, they can continue cutting taxes on rich people (more cuts are in the budget this year), forcing cities and towns to raise property taxes. These cuts will continue to devastate maintenance and other spending programs intended to save money in the future, making our future problems worse, and forcing tax increases to be bigger when some bridge falls down or worse. Meanwhile the increased property taxes will continue to be the most onerous tax for most businesses and people.

On the other hand, they can ask the rich to forego yet another tax cut, and maybe even roll back their cuts to the bad old days of, say, 1996. They could use this money to relieve cities and towns of some of the crushing burdens they face, and forestall property tax increases. Who knows, we could even fix some bridges.

I'm sorry to break this news to you, but some taxes will rise whatever the Assembly does with the state budget this year. The question before us isn't whether to cut taxes or not. As I said, that's a childish framing of the question. The real question before us is who pays? Do you want our children to pay, or shall we? Shall we ask people who have the most to share what they have, or demand more from people who have little or none? These are the real questions, though unpopular. The real proof of political courage will be a willingness to ask them, not more yammering about supposedly hard choices.

15:07 - 11 Apr 2009 [/y9/cols]

The NCSL mistake rears its ugly head

In 2007, the National Conference of State Legislators made a terrible mistake about RI's budget, calling a tax that had been on the books for a dozen years a "$70 million tax increase." They were wrong, but the error lives on, most recently in the RI section of this document, brought to my attention by the organizers of the tea-bag rebellion business.

You can read the original column, or the followup regarding NCSL's use of copyright laws to prevent me from showing their errors to the reading public, such as it is.

13:32 - 11 Apr 2009 [/y9/ap]

Sat, 04 Apr 2009

Keep Coastway Credit Union small: Vote NO!

Coastway Credit Union, based in Cranston, but with several branches around the state, is one of Rhode Island's unsung successes. A modest-sized community credit union with about $300 million in assets, it provides a good deal in bank services to its members. I haven't managed to see detailed financial reports, but from the accounts I have seen, they are a solid, well-run institution. This month they are asking their members' permission to convert from a credit union into a mutual bank. They are a credit to us all, and that's why I hope their members vote NO.

Among the first things I had to learn about in my career as a public policy nerd was credit unions. Only those who weren't here won't remember how some high-flying local banks and credit unions managed to bankrupt the meager resources of the local bank "insurance" scheme in 1990. Around a third of the state had money frozen in the collapse, and the economic devastation lasted years. Over the next decade, the state paid around a billion dollars -- an entire extra year's worth of taxes -- to make up for the idiocy of a relatively small number of bankers with ambition.

What else have the marvels of our financial sector done for us? We deregulated banks in the 1970's, savings and loans in the 1980's, insurance companies and commercial banks in the 1990's and investment banks in 2000. What did it get us? Huge bank fees and usurious credit card rates, the savings and loan crisis of the 1980's, the Rhode Island credit union fiasco of 1991, the current global credit meltdown, and more.

According to what passes for economic theory these days, unregulated finance is "agile" and "smart", able to flow where it's needed to accommodate a growing economy. According to the real world, it has been an net disaster for almost all concerned, save only the small percentage of people whom it has made very very wealthy. It may have made the dream of home ownership possible for millions of Americans, but it also bankrupted our economy along with many of those same homeowners, lured valuable talent away from careers in engineering and science, exalted essentially unproductive finance at the expense of our nation's manufacturers, and created the economic forces to give us a permanent affordable housing crisis. Go, rah.

On the local scene, over the past 25 years, our state's politicians have regularly stood on their heads to please our big banks as they grew and grew. We cut the bank deposits tax on their behalf and laid down the red carpet whenever they asked. Fleet Bank CEO Terry Murray was instrumental in lobbying for lower income taxes on the rich, and we even gave him a discounted mortgage from a program for low-income borrowers in the 1980's. What did we get?

Fleet Bank, our biggest star, grew so much it's now based in another state, as are most of its jobs. Hospital Trust was once a community institution, and it grew and grew, too, until it became a fat target for out of state players, who ate it up. The lasting benefits of their growth have now gone to other people in other states. Here at home, they offered more jobs, but as they grew, they provided less and less credit to people and businesses here, focusing their business on markets far from home.

The economy won't run without banks, but that doesn't mean we should let banks run the economy, which is what we've done.

So what does all this have to do with Coastway?

What a credit union is for is to take its members' deposits and loan them back to those members. A credit union has some natural brakes on its growth. For example, they are supposed to limit their lending to their members, and they have more restrictions on how much they can lend than a bank does.

Coastway says it has much more demand for commercial loans than it can supply, and they say that's a big part of why they want to convert to a bank. Coastway wants to grow, but can only do it the old-fashioned way, by expanding its membership and taking more deposits, which is slow and hard. But what's the right solution? Is it to let Coastway cast off its shackles and grow to meet the demand for its service by joining the high-flyers?

There are interesting arguments worth having about whether the credit union model is still relevant in today's world of banking, or whether credit unions that have grown large can still act as they were originally intended. But the bottom line is this: I don't want a state full of high-flying financial players that used to be little community institutions, and neither should you.

I want a state full of little community institutions, who turn out to be the stable, smart -- and possibly a little boring -- players in our financial system. If the market demand for credit can't be met by the current market players, that's an opportunity for some entrepreneur to enter the market to meet it. Better to let it be met by new players than by rule changes to make the old players bigger. We don't need more streamlined, high-flying (and fuel-sucking) jets around here. We need a fleet of sturdy little biplanes to do the job.

As a matter of public policy, this is one of those unusual moments when citizens have the power in their hands to do something, and don't have to wait and see what the elites in the state house will do. Coastway is democratically run, and its owners -- the depositors -- have a voice in the matter. They can vote against the conversion, and I hope they do. Let Coastway remain what it is now: a relatively small institution, one of the unexciting but nevertheless crucial pillars of our state's economy.

11:43 - 04 Apr 2009 [/y9/cols]