What's this? A Book!

Or buy here: Light Publications, Powell's, or Bn, Amazon A look at the lousy situation Rhode Island is in, how we got here, and how we might be able to get out. Featuring

Now at bookstores near you, or buy it with the button above ($14, or $18 with shipping and sales tax). Contact information below if you'd like to schedule a book-related event, like a possibly entertaining talk on the book's subjects, featuring the famous mystery graph. Join the RIPR Mailing List! For a weekly column and (a few) other items of interest, click here or send an email to ripr-list-subscribe@whatcheer.net. RIPR is a (paper) newsletter and a weekly column appearing in ten of Rhode Island's finer newspapers. The goal is to look at local, state and federal policy issues that affect life here in the Ocean State, concentrating on action, not intentions or talk. If you'd like to help, please contribute an item, suggest an issue topic, or buy a subscription. If you can, buy two or three (subscribe here). Search this siteAvailable Back Issues:

Subscription information:

Contact:For those of you who can read english and understand it, the following is an email address you are welcome to use. If you are a web bot, we hope you can't understand it, and that's the point of writing it this way. editor at whatcheer dot net Archive:

AboutThe Rhode Island Policy Reporter is an independent news source that specializes in the technical issues of public policy that matter so much to all our lives, but that also tend not to be reported very well or even at all. The publication is owned and operated by Tom Sgouros, who has written all the text you'll find on this site, except for the articles with actual bylines. Responsibility: |

Fri, 27 May 2005

Golly gosh, what will I do with my income tax cut?

Well, probably I'll use it to pay my property tax bill.

According to this story, the Rhode Island Public Expenditure Council (RIPEC) is proposing a 12% state income tax cut. (About 3-4% for next year, apparently.) The story was silent on the proposal's reception by legislators, but we have to hope they'll laugh it out of the building.

This is probably one of the worst policy ideas to surface at the state house this year. And in a year where personal income tax cuts for executives of a small handful of companies are again on the table, that's saying a lot.

Property taxes are going to rise in virtually every town in the state this year. There is a crisis in local governments from Woonsocket to Westerly. Let's assume that, on average, property taxes will rise around 3% statewide. This is fairly conservative, since many towns will see higher increases, and a few are bumping against the state-imposed 5.5% cap.

You have to be earning well north of around $150,000 in this state before your income tax bill is greater than your property tax bill. (This varies by town, of course. In North Kingstown, the number is about $150,000, in Narragansett it's more like $120,000, while in Providence it's up past $200,000.) This means that 3% up on the property taxes and 3% down on the income tax will mean that next year, the richest 4% of Rhode Islanders will be paying less taxes than the rest of us. The rest of us, of course, will be paying much more. Taking the same amount of money, and figuring out how to make it into a property tax break would lower taxes for everyone. The second is more challenging to do, but the difference seems worth it, at least to our team of analysts.

08:59 - 27 May 2005 [/y5/my]

Thu, 26 May 2005

The Potowomut School is poised to close. Too bad about the Governor's reduction of state education support.

15:12 - 26 May 2005 [/y5/my]

Wed, 25 May 2005

To read about the idiocy of the recent "debate" about judges, and how our press fails us, there is little better than this. Scroll down (the top is pretty good, too, but more focused on the press itself) then enjoy.

12:00 - 25 May 2005 [/y5/my]

More tax cuts for the rich (what else is new?)

Once again, by not addressing the question of who pays, the state is poised to give tax cuts to the wealthy, at everyone else's expense. In today's paper, it appears that money from a new contract with the new owners of Lincoln Park would go to finishing off the property tax on cars.

Eliminating the property tax on cars was proposed several years ago by Tony Pires, the former head of the House Finance Committee, and a 2002 candidate for the Democratic nomination for Governor. The idea, though, was to phase it in as an exemption on the first dollars of a car's value. So in year 1, the refunds to the towns allowed them to exempt the first $1,000 of a car's value, year 2 was for the first $2,000, and so on.

It was never clear that the state could handle this much tax cut, and it was certainly clear that the state wouldn't be able to pay for this cut and the 10% income tax cut passed the same year. The income tax cut was Governor Almond's idea, and neither he nor Pires would give in on their pet idea, and the House passed them both. The House Fiscal Advisor said to me at the time, "The chairman [Pires] believes the state would benefit from some fiscal constraints over time." So I guess no one was worried.

Well, my predictions turned out to be true: the state can't really afford those cuts. The Assembly stopped the car tax exemption at $4,500 a few years ago, and it has stayed there since. Now they see a golden opportunity to finish the job. But — to point out the obvious — tax relief granted this way would only go to people whose cars are worth more than $4,500, and the vast bulk of it would go to people whose cars are worth substantially more. Are these the people most in need of tax relief?

It is true that the municipalities with the highest car taxes are those that have the poorest populations: Providence, Central Falls, Woonsocket, etc. But exactly zero relief would go to anyone in those communities whose car is worth less than $4,500.

11:59 - 25 May 2005 [/y5/my]

Tue, 17 May 2005

We received a note:

And for the record II, the Governor did not reduce education funds. His FY06 Budget proposes a 2.1% ($15 million) increase in direct aid over FY05--not counting increased teacher retirement funds, school construction funds, intervention funds for the department of education, charter school funding, and support for the Metropolitan and Davies schools.

The word "cut" is problematic, and should probably be banned from the policy lexicon, since people disagree about its definition. When a Governor or President cuts some program, what does that mean? Does it mean less money? Less money after you take inflation into account? Does it mean a decrease in the program, or just a decrease in the program's rate of growth?

The complaint is made above that the Governor's budget this year contains a 2.1% increase in funds that go to a school's bottom line. According to the Bureau of Labor Statistics, inflation is currently running around 3.1%, and all the predictions I know of are for it to increase over the next year, as fuel prices and health care costs continue to drive up other prices. So is this an increase or a cut?

What's more, the CPI is meant as a measure of how hard it is to balance a household budget, using a typical mix of groceries, more durable stuff, and services. As a measure of how expensive it is to run a school, it's only a rough guide. Schools do buy carrots, for example, but — unlike households — they also buy pensions for retired teachers, professional development services, as well as copy machines, public liability insurance, and those funny little signs that say the floor is wet. It's not at all obvious that the CPI is a good measure of the prices of these items. It's harder to get cost efficiencies in something as labor-intensive as education compared, say, to finding efficiencies in manufacturing cars, and it's natural to expect that the prices of the labor-intensive good rise faster. This is not necessarily a good thing, and funding expenses like this with slower-rising taxes is a problem that needs to be solved, but I don't think this problem can be solved by sweeping it under the CPI rug.

(Here, incidentally, is a report outlining some of the reasons school costs have risen dramatically since the 1960's. The authors suggest using a "Net Services Index" to track inflation, and they present a way to make one.)

And all talk of indices aside, it was crystal clear to the Governor that pension costs were going way up this year (20% increases, a bit less than a quarter of which is discretionary and could be made to vanish with the stroke of a pen) and that health insurance costs are continuing on their merry way to the heavens, too. My town's schools, for example, were hit with $1.2 million in increased pension costs, around $300,000 of which isn't necessary, while the Governor's budget offers us just $50,000 more in state funding to deal with it. For this kind of largesse we should be grateful?

President Bush is currently using the same semantic obfuscation to sell his Social Security plan. "It's not a cut," say his defenders. "Just a decrease in the rate of growth." Well, the recent history of linguistics shows that one can argue points of semantics for a long time without resolution. One is more likely to find agreement on the actual outcomes of actions. So here are some outcomes. Under the current system, or under the Bush plan, the dollar amount of my pension will be more than I'd get if I was 65 today, so the President feels free to characterize his proposal as not-a-cut. But under the current plan, I will see around 36% of my working income in my Social Security check when I retire. Under the Bush plan, I'll see around 20%. Who cares what you call it?

Meanwhile, state tax revenues are up, and the state income tax is up over 7% from last year (which was up 10% from the year before). And yet, under the Governor's budget — which isn't a cut, remember? — the school in my neighborhood will be closed, and my daughter will move to a different school, to save money. (To be fair, it's the Town Council's budget, too, and they're playing the same game.) Everything you could characterize as a frill — library books, music, language classes — is on the chopping block. Really, who cares what you call it?

08:53 - 17 May 2005 [/y5/my]

Sun, 15 May 2005

For those who really need a smoking gun before they know a lie, well now we have it. Check here for an account of the British memo describing Bush's plans for attacking Iraq — months before Bush asked the UN for a resolution on the subject.

An account of the memo appears in the New York Review of Books this week. It's reprinted here along with some other useful links.

"C reported on his recent talks in Washington. There was a perceptible shift in attitude. Military action was now seen as inevitable. Bush wanted to remove Saddam, through military action, justified by the conjunction of terrorism and WMD. But the intelligence and facts were being fixed around the policy. The NSC had no patience with the UN route, and no enthusiasm for publishing material on the Iraqi regime's record. There was little discussion in Washington of the aftermath after military action."Seen from today's perspective this short paragraph is a strikingly clear template for the future, establishing these points:

- By mid-July 2002, eight months before the war began, President Bush had decided to invade and occupy Iraq.

- Bush had decided to "justify" the war "by the conjunction of terrorism and WMD."

- Already "the intelligence and facts were being fixed around the policy."

- Many at the top of the administration did not want to seek approval from the United Nations (going "the UN route").

- Few in Washington seemed much interested in the aftermath of the war.

Again, you'd think this would be news enough to appear in some daily newspaper or another. Maybe even one around here.

23:10 - 15 May 2005 [/y5/my]

Thu, 12 May 2005

Me and 1,000 of my closest friends

Me and around a thousand other people showed up at the state house yesterday to make a noise about funding education. The state's actions have been scandalous over the past decade, and it's time for a change. I continue to wonder why the Governor (or some candidate) doesn't see the importance of fixing the system in a basic way, instead of just complaining about malign union influence. (Here's one suggestion.) Anyway, it now seems the state will have a little more money next year than they'd anticipated. These are the people who need to hear from you this week about how it ought to be spent:

- Steven Costantino House Finance Chair, 521-1313, (222-2738 for Finance staff)

- Gordon Fox, House Majority leader, 331-9090, 222-2447

- Bill Murphy, Speaker of the House, 861-1142, 222-2466

- Don Carcieri, Governor (remember him? reducing funds for education was his idea)

Your own state rep would also be a good idea. See here for a contact list.

Update: A correction was offered, and hereby made: the Governor's idea was only the effective reduction in funds for education. The dollar figure actually went up, though less than the inflation rate. See clarification above: When is a cut not a cut?

08:30 - 12 May 2005 [/y5/my]

Wed, 11 May 2005

It appears that no sooner had the possiblity arisen that the state would have more money than anticipated, than the Gov started talking about tax cuts.

Mark us as uncertain of the wisdom of this. I enjoy getting money in the mail as much as anyone does, but I also enjoy not having schools close, having people who need food and medical assistance being able to get it, and a state without a mountain of debt. The Governor was all apologetic about not being able to serve these needs when he presented his budget in the spring. Are we to believe now that he wasn't sincere then? One would think he'd be happy to be able to revisit those "tough choices" equipped with more money.

What's worse, the Governor's analysis of our state's tax burden is, well, why don't we just call it shallow. In his public comments, he gives the impression that we all pay the same burden of tax. Well, we don't. Some of us pay more income tax than sales tax, and some the other way around. Some pay a lot of property tax, and some don't. The very richest among us pay more income tax than property tax, but for the rest of us it's the other way around. (See RIPR 2 for some entertaining detail.)

Without acknowledging the complexity of the tax burden, the Governor virtually guarantees that any tax cut he offers will benefit only those who need it the least. Like him.

In the meantime, if he really can't see his way to offering it to help the poor or to educate our children, how about battening down the hatches for the coming storm? We've got a lot of debt that could be repaid.

Some intimations of what's ahead are here.

15:53 - 11 May 2005 [/y5/my]

Tue, 10 May 2005

The May revenue estimates are out (Projo). The income tax is up, by quite a bit, over the estimates of just last fall. Property taxes will be up, too, this year. But the income tax rose despite no raise in the tax rate, whereas the property tax increases will be increases in the rate. No one will feel the increase in income tax revenue, but some people will be forced to move from their homes because of the increase in property tax revenue.

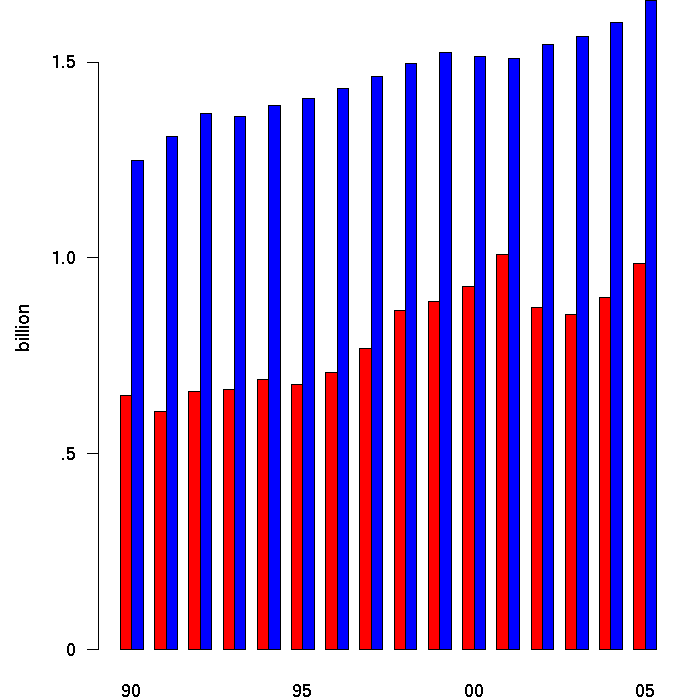

Here's a chart of property taxes (blue) and income taxes (red) over the past fifteen years. Over that time, property tax rates have gone through the roof, while the income tax rates have stayed constant, or declined. Despite that, the income tax is catching up.

Wouldn't it make sense to shift some of the burden on towns to the more rapidly growing tax?

The April RIPR contains some detail about how this could be done, and result in a tax cut for 85-90% of the state. Read it now, and then why not subscribe?

10:31 - 10 May 2005 [/y5/my]

The April RIPR is now available free in the archive. Subjects:

- School funding and tax fairness. They're more related than you think. A reform suggestion to provide real property tax relief to around 85% of the state.

- Book review: Rethinking Growth Strategies from the Economic Policy Institute, a review of the available research on tax incentives and business location decisions.

Sound good? Ok, so it's not bedtime reading. But it's your state, too. Find out what's happening to it. Why not subscribe? We'll even send you some free tattoos...

09:06 - 10 May 2005 [/y5/my]

Mon, 09 May 2005

Spending money, making us less secure

This seems to be the goal in most recent security legislation. (See here for example.) Now comes the Real ID act, which will turn driver's licenses into de facto national ID cards. (Read about it here.) Remember, a national ID card will not improve security without a national database. Now imagine how many people will need access to that database — airline ticket agents, police, schools, whatever. Now ask whether the technology exists to keep this much data both easily accessible by the millions of people who need access to it, and secure from being hacked.

It's attached to a must-pass bill in Congress, so apparently it's coming, like it or no. (Via Eschaton.)

23:08 - 09 May 2005 [/y5/my]

The goals of community development

An op-ed in today's projo brought this essay to my attention. The author, who works in community development agencies in Brooklyn, points out that the "ownership society" has its pitfalls, too. His fear: that home-ownership, being a relatively high-stakes kind of affair, promotes concern with one's property value over concern for one's community.

As someone who watched incredulous as his neighbors organized a high-profile campaign against a proposed bicycle path through our town — including turnout at town council meetings greatly exceeding the turnout of people who wanted to talk about the school budget — I have to agree with the author. The bike path (in any form whatsoever) is now dead and gone, and so is my hope that community spirit be anything more profound than cheering on the high school sports teams.

Ownership is a good thing, but to pursue it at the expense of everything else is a mistake. It's a small planet, and we're not going to be able to share it successfully if the only focus is on getting mine. Building community institutions — schools and libraries, but also pension systems and health plans — is how we build a life that depends on each other. If we finance the ownership society by letting those institutions decay, or ignoring the opportunities to build them, we'll only be greasing the skids for our descent into Hobbes's state of nature. Not a pleasant outlook.

08:55 - 09 May 2005 [/y5/my]

Sat, 07 May 2005

Newspapers all over the world are reporting that Britain's government knew for sure that the US Government was intending to go to war (not just planning to go to war) with Iraq in July of 2002, months before the ultimata and the UN votes. Here's a story in one of the few US papers that think it newsworthy.

So far as I can tell, this hasn't appeared in the Projo, unless it's in the East Bay edition. One would think this was news.

23:02 - 07 May 2005 [/y5/my]